2026 Real Estate Market Update

Arizona Real Estate Market Update — January 2026

The Arizona housing market is showing some momentum to kick off 2026. After a slow second half of last year, buyers and sellers are both getting a little more active in the market. What’s behind this trend, and does it have staying power?

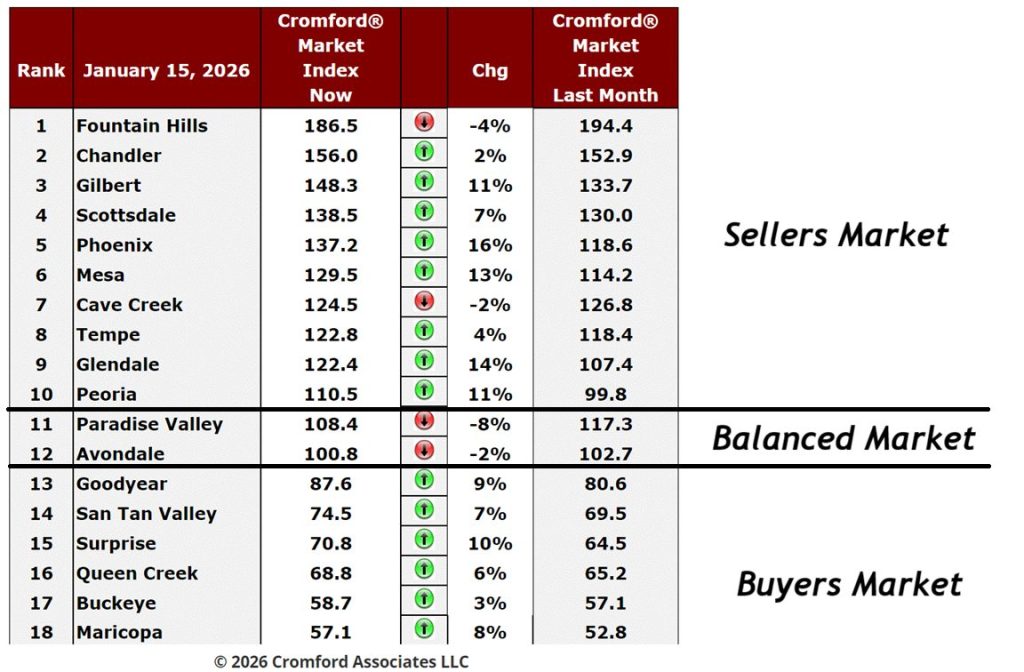

Market Conditions: Stronger and leaning toward sellers in many areas, but buyers maintain control in others.

Across Arizona, key indicators show us some interesting stats:

- Listings under contract are up compared with this time last year. 14.7% of listings are under contract, versus 11% at this time last year.

- The number of properties coming on the market to start the year is less than last year. (5.5% new added this year, versus 8.9% at this time last year)

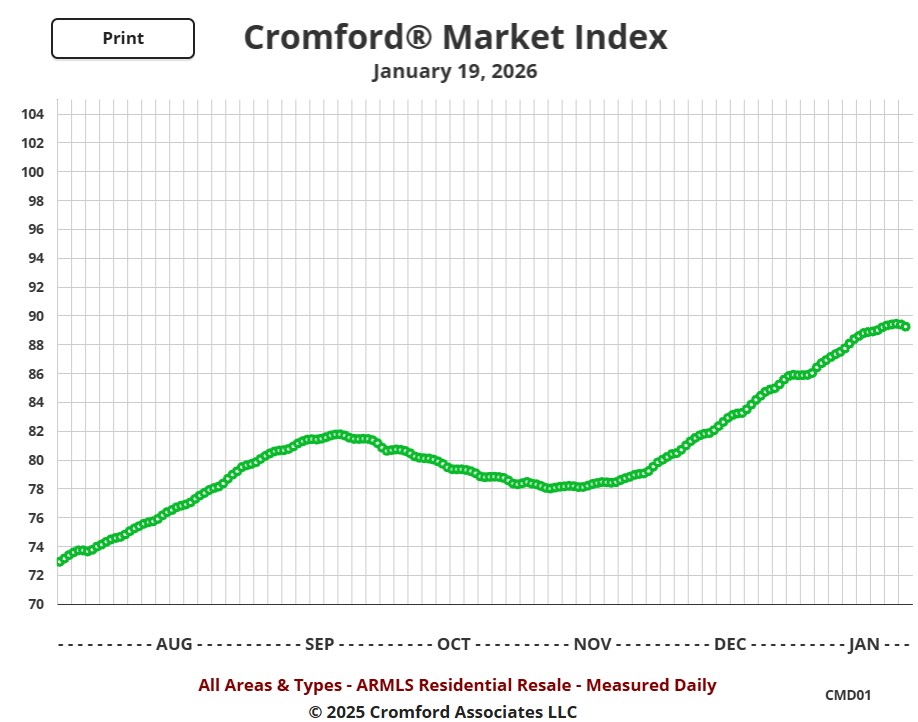

- The Cromford Market Index — a widely followed measure of how balanced things are between buyers and sellers in Phoenix — is at its strongest in roughly 12 months and just a few ticks away from a neutral market

What’s Driving Purchases?

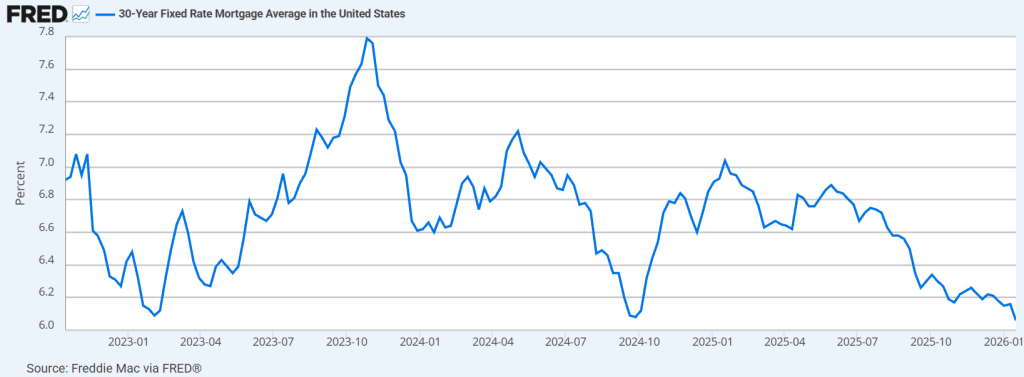

Reduced interest rates are the primary driver behind buyers coming into the market in stronger numbers than last year. With rates a full 1% lower than this time last year, many buyers who have been on the sidelines waiting for better rates are starting to emerge from their rate-induced hibernation. As of writing, rates are currently in the high 5% to low 6% for a 30-year fixed.

A major factor behind the rate drop this January was the recent government plan to buy mortgage-backed securities (MBS). President Trump directed that Fannie Mae and Freddie Mac purchase up to $200 billion in mortgage bonds, which bolstered the mortgage bond market, helped push yields lower, and in turn supported lower mortgage rates almost overnight.

This kind of intervention isn’t typical and while markets will continue to react to broader economic conditions, the headlines have already helped tilt the mortgage market in buyers’ favor.

So – a combination of less homes coming on the market, and more demand from buyers means the market index rating is up, and nearing a “balanced market” valley-wide. As always, individual cities, zip codes, and neighborhoods can follow micro-markets and have different conditions than the market average as a whole. Ironically, few areas actually fall into this market average range, and it’s more-so that some areas performing well, and other areas are struggling that balance each out.

What This Means for You

For Buyers

- Lower mortgage rates and more inventory create better buying conditions than in the past two years.

- Monthly payment math is improved year over year.

- It generally makes sense to buy now on better terms and plan on refinance later, rather than try to compete with the masses if/when interest rates drop even further.

For Sellers

- The market is rewarding “right-priced” homes. Buyers are somewhat active, but they’re disciplined. Homes that hit the market at fair, data-backed pricing are seeing strong showings and faster offers, while overpriced listings are sitting.

- Presentation can be a differentiator. With more options on the market, homes that need work or feel dated or neglected will not get the same interest as newer and well maintained homes.

- The spring surge is coming. getting ahead of it may benefit from less competition for the buyers that are out there right now.

For Refinancers

- If your current rate is significantly above today’s average (7%+), it may be a compelling time to consider refinancing, although there are likely better rates to come with a bit more patience. (However, do not expect 3% rates to make an appearance any time soon or ever at all.)

As always, please let me know how I can help you reach your real estate goals.

REALTOR®

Contact Me

Comments are closed.