Market Update

As MLB spring training gets under way and temperatures begin rising, I’m starting to think Punxsutawney Phil was wrong about 6 more weeks of winter this year. With the Phoenix area at maximum occupancy from seasonal visitors, the real estate market is showing it’s true colors. An interesting trend has developed that is segmenting the real estate market. Catch up with the latest Phoenix area real estate market update now!

Luxury vs Median

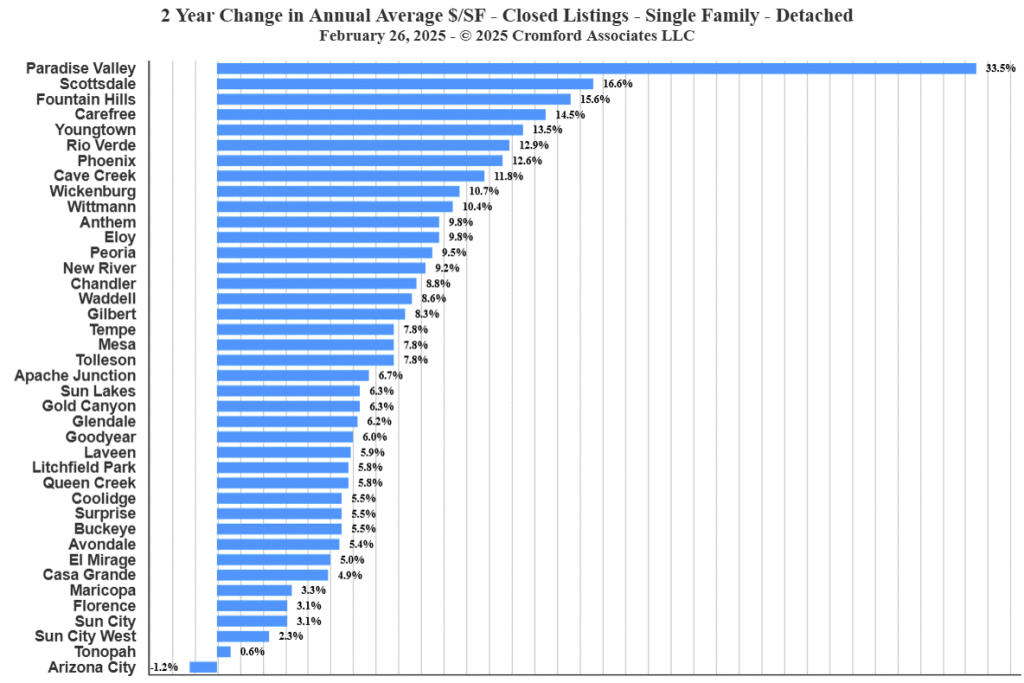

As the real estate market has more or less flatlined over the last year, meaning prices have not gone up or down much at all, and overall activity is lower than in years past, a stark trend has appeared. Luxury homes are not struggling nearly as much as the every day home. In fact, the luxury sector is thriving. Take a look at this chart, which shows a 2 year change in annual price per foot.

While all of your typical luxury cities are represented, Paradise Valley, an exclusively the luxury market, is on a whole other level at a massive 33% increase in average price per foot over the last two years.

This primarily has to do with higher net worth individuals not being as sensitive to interest rates like the larger majority of home buyers, and the limited amount of opportunities available in the area.

While we say ‘flat market’, keep in mind that is often used in conjunction with inflation. The last 2 years the consumer price index is up around 7%. Through an investment lens, properties have shown mild appreciation over the past 2 years, however the bottom half of the chart has not kept up with inflation, and the top half has beaten inflation by various margins.

Interest rates

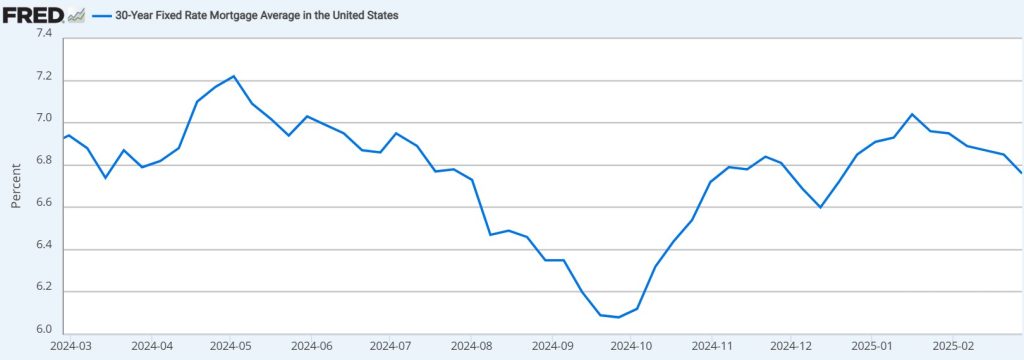

For the majority of home buyers, mortgage interest rates continue to be a thorn in their side – nothing new here. While we briefly saw rates as low as 6% in September of 2024, they once again went up reaching 7% in mid January. Since then, a gradual move in buyers favor means current 30 year interest rates are averaging 6.75%

While predictions for rates 6 months ago were a sizeable improvement/decrease that has not yet occurred, current predictions for mortgage rates have them holding fairly steady for the foreseeable future. Of course predictions are just that, and no one really knows. With Trump in office, anything can get shaken up at any time that could have direct impact on rates and housing.

Home Sellers: Have patience, and be realistic. Buyers have options to choose from – Overpricing your property is generally not a good idea. Expect buyers to want to negotiate a little. The nicest AND best priced homes will sell. Overpriced properties and homes that need too much work will struggle for traction much more than in years past.

Buyers: You’ve been asking for more options with less competition for years – now’s your chance. If you can afford the current rates you will still have opportunities to refinance in the future. You can negotiate concessions to buy your rate down as a part of an offer. Large new home builders continue to offer promotions with reduced interest rates to buyers that are hard to beat on the resale market.

As always, please let me know how I can help you with your valley real estate needs.

REALTOR®

Comments are closed.