Rates…Rates…Rates…

Rates…It’s all we seem to hear these days. The Phoenix real estate market has been affected by interest rates in some unexpected ways. New home builders are bulldozing their way through the slower market and leaving individual home sellers scratching their heads. What do home sellers need to do to gain an edge? Should buyers pull the trigger now? Where do interest rates go from here?

By the Numbers

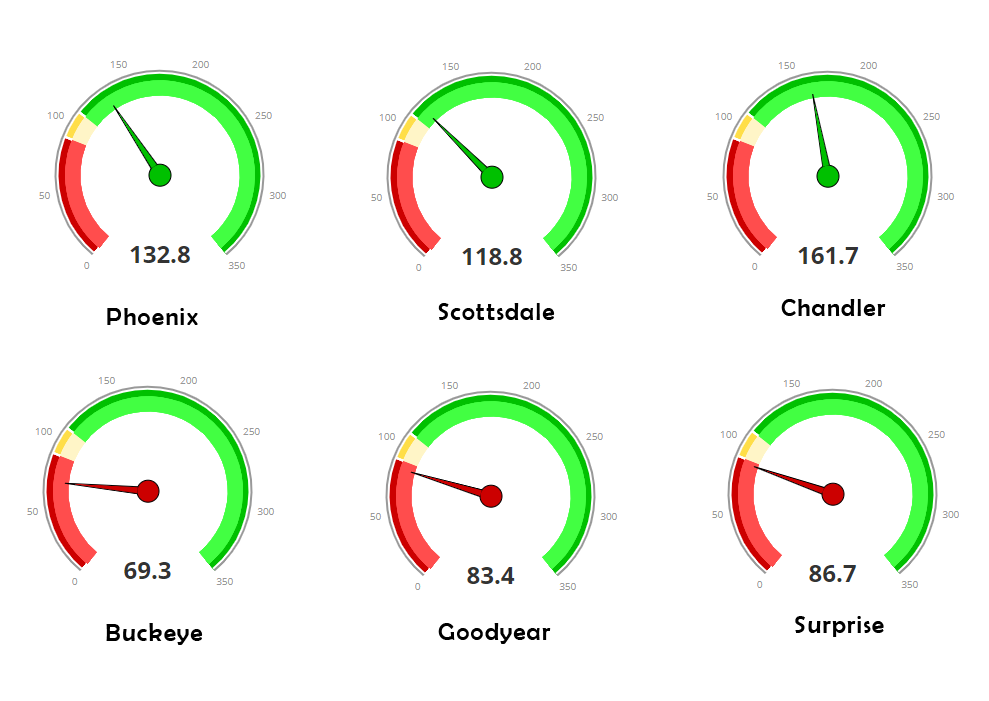

Looking in the rear-view mirror, the average sale price for October in the Phoenix metro area was $579,000, which is up from $516,000 at the start of 2023 – good news for home owners, and bad news for buyers who have continued to wait on the sidelines, or have been pushed out of the market due to higher interest rates. However, this is still down from the all-time high of $592,680 in June of 2022.

Starting in August of this year, the continued increased interest rates have slowed buyers down, allowing the number of available homes to start increasing. There were only 9,600 homes for sale in August, with around 16,000 available homes right now.

Put it together, and the Phoenix area market is currently teetering on the edge of a sellers’ market and a balanced market– but of course varies greatly by the part of town and price point.

At the bottom of the pack dragging down the average and firmly planted in a buyers’ market is Buckeye. Cash buyers, and buyers who can float and/or stomach a higher interest rate for a period of time have opportunity to negotiate and potentially get a great deal on sales price and other terms. Buyers will have negotiation power, and prices are softening here and a few other “edge-of-town” municipalities.

Meanwhile, Chandler is the best performing city of the bunch. Home sellers in Chandler and other top performing markets are technically speaking in sellers markets. Anecdotally however, home sellers sitting on the market might feel like it’s a buyer market, as activity has dwindled the second half of the year.

New Homes

Builders are remaining resilient due to their ability to offer “in-house” discounted mortgage rates. These reduced rates can be anywhere from 1-2% below the going market rate for a fixed 30 year mortgage, and as low as 3-4% below market rate for temporary 1 or 2 year “buy down” rates.

I have seen some rates as low as 3.99% for your first year in a new home. For example, a home-buyer putting 10% down on an average priced home of $579k using this builders financing could save over $1,200/month in year one, $900/month in year two, and $700/mo for years 3-30 (or until refinanced). These are some BIG savings versus market rate mortgages.

When Will Rates Go Down?

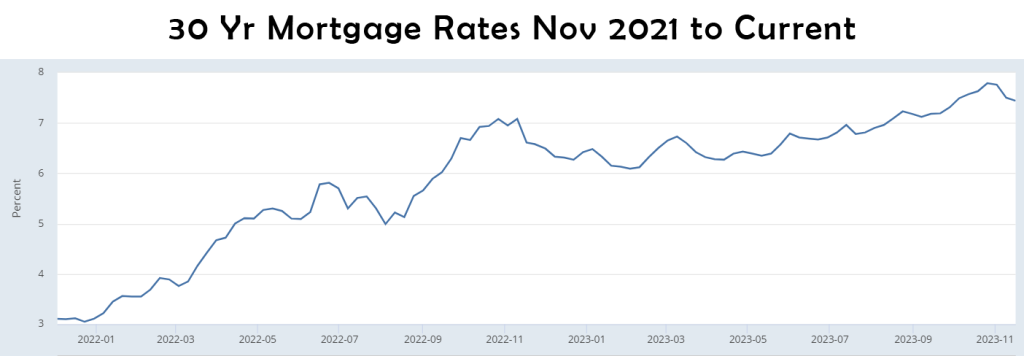

Mortgage interest rates have likely peaked, and exhausted the continual run up that kicked off 2 years ago. Economic data points to no additional rate hikes being likely at the federal level. The question that follows as we look into 2024 is WHEN will rates start to come down.

Looking back at the last high interest rate peak of the 1980’s, interest rates dropped by about 15% per year for the following years after the peak. If rates were to follow a similar path now, that means we’d be looking at mortgage rates around 6.8% a year from now, and 5.75% in 2 years from now.

Of course, this is just hypothetical, and I don’t claim to predict the future…but it does remind us that it’s not likely (nor necessarily good for the economy) for rates to suddenly plummet. In other words, “low” interest rates won’t happen overnight and higher rates may stick around for a little longer than eager buyers might prefer.

By the way, home prices increased by 16% in the 5-year period following the peak of mortgage rates in the 1980s.

Sellers

If you are selling a home in a market that has a large new construction presence in the immediate area, it can be more difficult to compete with new builds offering discounted mortgage rates for financed buyers. If a buyer could buy a similar home that’s brand new, and for less money every month, why wouldn’t they? Inner city and more urban area sellers don’t have this competition.

You might need to offer concessions to keep buyers engaged. In 2021, 10% of sellers paid concessions towards buyers closing costs with an average amount of $3,000. Right now, that number is close to 50% of sellers paying towards buyers’ costs, with an average amount of $9,000. This can be tremendously helpful to buyers who need the extra funds to help buy down rates, or cover additional expenses.

As with any market, the well-priced, well kept, and nicely finished homes will be the first homes to sell. This is more so apparent in today’s market where buyers are starting to have more options than they did in the past. Fixing, staging, and making sure the home is the most appealing home on the block is as important as ever.

Buyers

From a financial perspective, yes, the rates are higher than you’d like, but still less than the “100% interest” that’s paid on rent. You finally have some choices in finding a home. With inventory creeping up it’s much less stressful to find the right home in the right location, and most buyers don’t have to compete with ten other buyers for the same home.

Power is on your side in many situations right now, but you should also not get too comfortable with that notion, as it could change quickly. Just in the last couple weeks, interest rates moved down a third of a percentage and there was a small, but measurable, increase in mortgage applications which popped to a 5 week high. Just a small change in average rates from 7.9% to 7.6% sparked an increase in buyers – so what will happen when rates go down even further from here?

It’s a strong and clear sign that as the mortgage rates do start subduing and more and more buyers come in from the sidelines the market can, and will, shift quickly. After all, there is still a housing shortage going on. The longer the market stays subdued the more the pent up demand will continue to build up.

As always, please reach out if you have any, housing, real estate or mortgage related questions. I am here and available to help, and guide you through your real estate sale/purchase.

Realtor®

Comments are closed.