Market Snaphot: Rising Interest Rates

If you have been paying attention in the last year or so, you’ve heard talks about the possibility of interest rates rising. While we expected to see it happen in 2017, 2018 will be the year. While interest rates affect everything from retirement accounts, stocks, inflation, we’re just talking about mortgage interest rates and how they affect the real estate market.

What are the current rates?

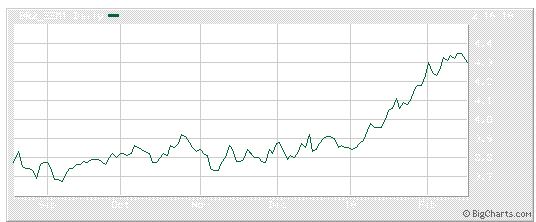

Current mortgage rates are around 4.5% for a 30 year fixed mortgage, up from around 4.1% in January of this year. It may not sound like a lot, but on a $500,000 mortgage that’s an extra $42,000 over the life of a loan. The last time we saw 4.5% was in 2014 for a brief period, before it pulled back down. It’s a fairly sizable amount to increase in just 6 weeks.

Where will they go?

Heading into 2018, experts agreed we would most likely see 4.5% by mid-year. Needless to say we’ve eclipsed that expectation. The big question remains, will we stay put for a while, or will rates continue to rise through the popular spring home buying season? If expert opinions are right, the probability is we will continue to see the rates rise through the rest of the year.

How does it affect me?

The effect on consumers buying real estate is somewhat obvious. They will have to pay more monthly on their loan due to the higher interest rates.

The big concern and next seemingly logical question is that since buyers have to pay more, it will decrease demand and will decrease the value of homes. This is simply not true. In fact there is very little correlation between rising interest rates and property decreasing property values.

Since rising interest rates occur in a good economy, this indicates people have jobs, incomes are up, and unemployment is down. These factors are greater forces when dealing with home prices than interest rates alone.

This means rising interest rates don’t usually deter a lot of buyers from purchasing all together, but it may persuade them to buy a slightly smaller, or slightly less expensive home.

Historically speaking, we are still at low interest rates. Remember mortgage interest rates were at 16% in the 80’s and 7-8% in 2006. It’s hard to want to pay more than what we have become accustomed to in recent years, but the reality is what we have now just may be the lowest rates we will see for a very long time.

Sellers: Don’t worry that rising interest rates will decrease the value of your home. We are expected to see around 4% appreciation in 2018.

Buyers: Remember you are still historically low, but don’t expect interest rates or prices to come down anytime soon. The sooner you buy, the sooner you can lock in your investment, but it has to make sense for you.

Comments are closed.