Major Changes to Home Buying Costs.

Massive changes announced on Friday will impact the way homes are bought in a big way. For home buyers, there are a few critical items that you need to know when starting your home buying journey under these new proposed rules. Changes have not gone into effect yet, but if buying a home is on your list of goals for the year, it may soon get a bit more expensive.

The Back Story – Why the Change?

The National Association of Realtors (NAR) are the defendants of lawsuits brought by a few disgruntled home sellers who did not like the fact that home sellers fees typically cover the sellers AND buyers’ agents’ commissions. While this is more complex than most people understand, it has been a beneficial arrangement to all parties. This arrangement has allowed buyers, especially first-time buyers with less cash, access to quality home buying representation at no cost to them. This arrangement has been in place and worked for more than 100 years in the United States.

The NAR has agreed to make changes to how the home buying and selling process works that greatly effects real estate agents and consumers.

Changes for Home Buyers

In short, the settlement states that home buyers should be responsible for paying for their own Realtor. Starting in July of this year, home buyers will no longer have the guarantee of a knowledgeable Realtor to help them with the home buying process at no cost. The Buyers’ Realtors’ commission that used to be covered by the seller, is now going to be expected to be paid by the buyer at closing (in addition to down payment, loan and other closing costs). This amount has typically been 2.5-3% of the purchase price.

Furthermore, buyers are now going to be required to sign agreements with buyers’ agents that outlines their arrangement and compensation to be paid at closing. The days of casually calling up a Realtor to ask questions, look at a house without any sort of predefined written agreement are about to be over.

In one scenario, this may cause some buyers to attempt to avoid working with an agent altogether, and try to buy on their own to save money. The list of potential problem for those buyers not experienced in the process is pretty lengthy. It’s pretty simple to be dragged through the mud by a sellers agent who represents exclusively the sellers interests and not yours. From showings, negotiating, financing, to inspections, and knowing your rights and obligations, consumers just don’t know the intricacies of a real estate transaction like an experienced agent. The real estate market is more complex than ever. This unfortunately would leave the window wide open for buyers to be taken advantage of in a complex real estate environment.

Home Sellers Benefit?

On the flip side of the coin, the “benefit” here is that costs can be reduced for home sellers if they don’t have to pay the buyer side fees. At the end of the day, that’s what it was all about. But – It’s just not that simple. Most home sellers are also buying another home, which means they are on the other side of the equation again, and at the end of the day, it’s a same financial net cost for consumers for both transactions.

Additionally, the cost actually might not go away at all. There are other ways that sellers can contribute to buyers costs, in the form of concessions. It’s quite possible we may see sellers offering a 2-3% “concession” to the buyer as a standard practice, which then the buyer uses to cover the cost of their representation. This would end up not saving sellers at all, it’s just an old cost with a new name, and a roundabout way of carrying on what’s already in place.

These new rules still have to get a final approval by a judge. We are still very much in the early innings of this change. If you want a guaranteed way to buy a home with representation and NOT pay for an agent yourself, Realtor representation is still ‘no cost’ to home buyers for a few more months.

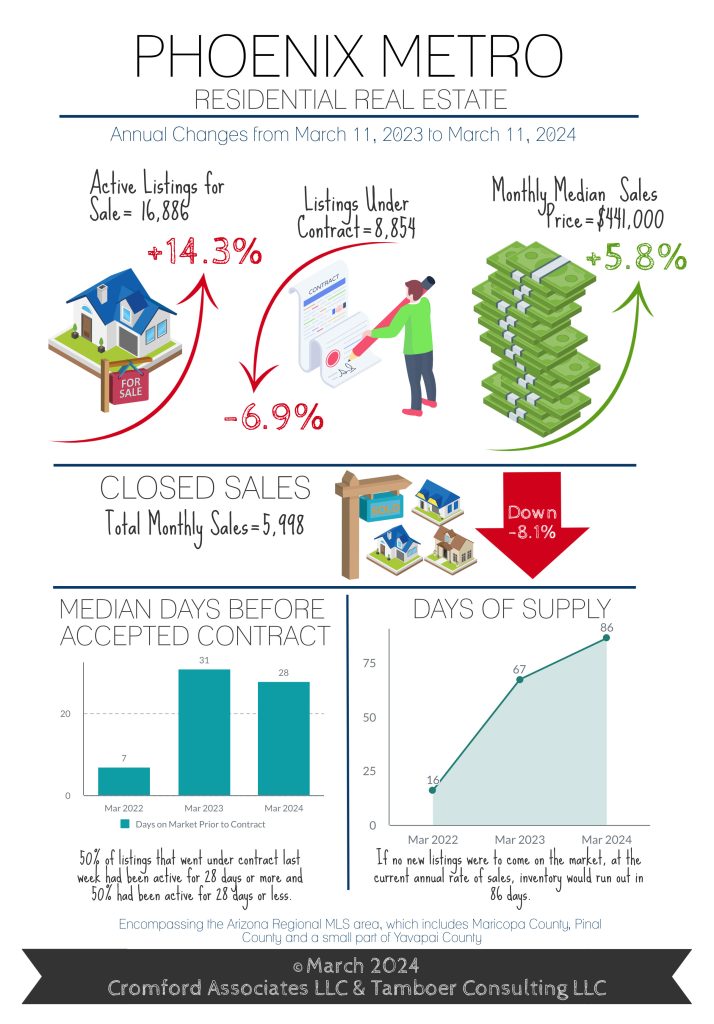

Market Update

As interest rates remain fairly flat to start the year, so do home prices. With rates mostly flat to start the year, we are maintaining almost perfectly balanced market. Higher than hoped interest rates keep buyers off the sidelines, and also suppresses current homeowners to move. Low inventory matched with low demand = home prices remaining fairly steady.

We are currently at a valley wide average sales price of $587k, up slightly from $568k in January. It’s taking an average of 67 days on market to sell a home, and sellers are accepting offers an average of 97.5% of list price. Mortgage rates for 30 year fixed are sitting just below 7% for most buyers, but new home builders continue to offer special financing as low as 4 or 5% and are an attractive option.

As in most markets, well priced and updated homes are the first to sell. Overpriced homes and homes with defects and in need of work will sit on the market longer than more appealing competition.

As always, I am here to help you with your real estate goals.

REALTOR®

Comments are closed.