Major Changes to Home Buyer and Seller Costs: Explained

Whether you’ve heard about the new changes made to buying and selling real estate or not, the time has come for these changes to officially go into effect. As of August 1, 2024 new rules mandate what sellers and buyers are allowed to pay for in a real estate transaction. As a buyer, or as a seller, here is what you need to know that will affect your bottom line.

Buyers

As if buying a home wasn’t challenging enough in todays high-cost, high interest rate environment, the new changes could add one more cost for home buyers. However, navigated properly there will be options.

Historically, when you worked with a buyers agent to buy a home, there was no cost to you as the buyer, and it was simple and easy to start looking at homes without worrying about compensating your agent. Buyers agents were always paid by the seller, who offered compensation for bringing and representing a buyer to the property.

With the new rules now in effect, all buyers must first enter into a formal agreement with an agent before ever viewing a property. No, we can’t even show you ONE single property without a signed agreement in place. This agreement is called a Buyer Broker Agreement. It is an agreement stating you are hiring the agent as your buyer broker, outlines their services/representation, and how much these services will cost you. No longer will it be customary to rely on sellers paying buyers agents compensation, it is up to YOU as the buyer to hire an agent to work with and help you with your purchase.

Now, it’s not all bad news for buyers. There are a few opportunities to get that fee covered so it doesn’t always have to come directly out of the buyers pocket:

- Sellers can still offer compensation to buyers agents – Compensation has been taken away from the MLS, and sellers are not required to offer compensation to buyers agents, but that doesn’t mean they can’t. Any given home seller may or may not be covering the cost of a buyers agent.

- Negotiate with the seller to cover the agents cost – Even if a seller is not offering to compensate the buyers agent, that doesn’t mean it can’t also be a part of an offer. (previously, this was not up for negotiation.

- Sellers can offer concessions to buyers, which buyer can turn around and use that to cover their buyers’ agents’ compensation.

If you followed along this far, you’re doing great! If It’s totally confusing, don’t worry you are not alone. However, it is more important now than ever to hire an experienced agent to navigate this growing and complex field of real estate land mines – you do not want to get blown up.

What services do I provide as a buyers agent?

New Home Developments

Better news for home buyers purchasing in new home developments, you may not feel the squeeze much at all. Home builders are still offering to pay buyers agents compensation, which means it’s business as usual, and you can use the services of an agent without worrying about added cost, and you can actually save additional money if you’re using an agent like myself to make your purchase.

The only real difference for new home buyers is buyers will need to sign an agreement with their buyers agent, prior to going to the new home community.

Sellers

On the surface sellers seem to be getting the better end of the deal here. Some of the “default” costs of selling a home have been shifted over to the buyer, but it’s going to wholly depend on the actual offer as to what the total expenses are going to be.

As a reminder of the way it previously worked – a listing agent may have charged a seller 6% of the sales price, and they would split that 6% with the buyer’s agent, hence the buyer’s agent was getting paid from the seller’s side of things.

Now as a seller, you are only going to need to compensate your own listing agent, which is likely closer to 3% – of course this fee is negotiable and depends on the agent, the home, market conditions, and more.

While totally optional, it is up to you as a seller if you wish to offer any additional compensation to a buyers agent, or offer concessions to a buyer to compensate their agent. At the end of the day, the less up-front costs to a buyer, the more enticing a home may be to that buyer. Even if you do not offer any of these incentives to buyers, there is a good chance buyers will likely still be asking for it on an offer.

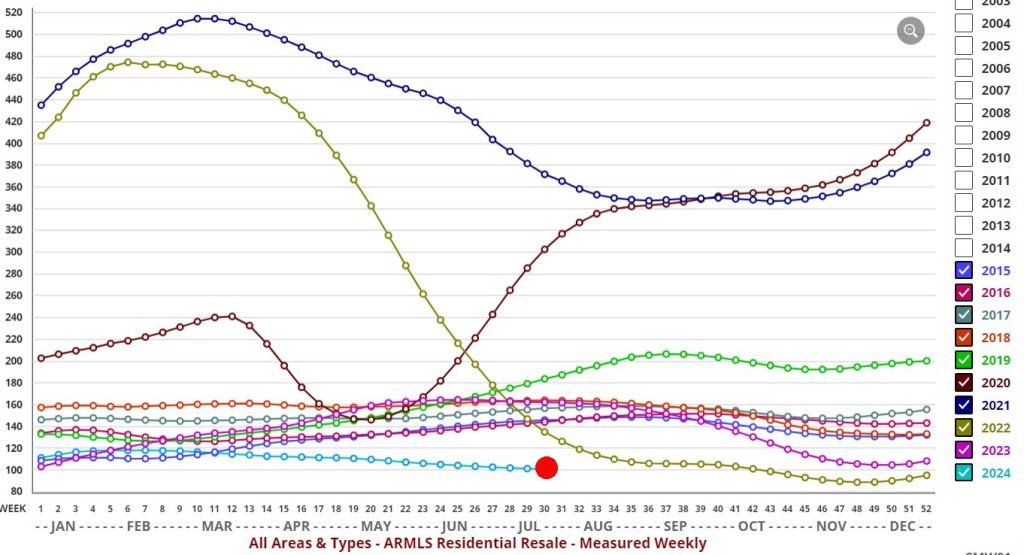

Market Update

Phoenix area real estate market is taking a much-needed breather. The mildest spring season in a decade, transitioned into an early summer slump. Demand is still dampened by high interest rates. Supply levels are climbing, but still low, which is keeping prices afloat.

At the end of July we drifted statistically into a “balanced market”, where prices are not expected to increase nor decrease in either direction. As interest rates hint at easing very slowly, and we head into an election this fall, I do not personally anticipate much change in buying/selling activity or to see many price changes in the coming months.

In this current market, sellers who are overpriced will likely not sell and will struggle to get showings. Homes that are priced appropriately and have all the right features will still sell, but it could take weeks (or more) to get an offer, rather than selling over a weekend. Buyers are paying good money for homes and can afford to be pickier for the right one.

For all the buyers who have said “I’ll wait until the markets not so competitive”, it’s your time to shine! Less competition means you can get the home you really want with less competition. Yes, rates are high, but you and everyone else will refinance soon anyways. Once rates fall, demand will pick up and I anticipate a fairly quick upturn as the pent-up buyer pool gets uncorked – we still have an underlying shortage of homes in Arizona, so the 2025 spring market could be a real rocketship, and it will likely cost you more to wait.

Stats:

Available Homes: 20,320 vs 13,945 at this time last year

Pending Sales: 4,441 vs 4,842 at this time last year

Average Days on Market: 66 days vs 59 days at this time last year

Average Price: $570k vs $557k at this time last year

Comments are closed.