How Recessions and the Stock Market Impact the AZ Real Estate Market

Recession fears are the talk of the town for financial markets this week with newly announced Tariff policies – but don’t be scared! How would a possible recession affect real estate markets, and specifically Arizona? How does the current stock market affect the real estate market? (And if you haven’t looked at your 401k today, I don’t necessarily recommend it, unless you’re buying more stocks on sale!) Understanding how both impact real estate can help buyers, sellers, and investors make more certain decisions—during uncertain times.

Recessions and Real Estate: More Complex Than You Might Think

When most people hear the word recession, they immediately think of doom and gloom—job losses, shrinking paychecks, and slumping markets. However, the relationship between recessions and real estate is much more nuanced. IF we were to head into a recession (and I certainly don’t have a magic 8 ball) it will likely actually be a boost to our Arizona real estate market. These are the types of concepts to keep in mind.

1. Lower Interest Rates = Greater Buying Power

One of the most consistent patterns during a recession is the reduction of interest rates. To stimulate the economy, central banks tend to lower rates. This often leads to cheaper mortgages, giving buyers more purchasing power. For those with stable incomes, recessions are a FANTASTIC time to buy a home. We’ve all been waiting on rates to come down for a while now, but the hand would be forced during a recession.

2. Softening Prices in Some Segments

While luxury and mid-range homes can retain value and appreciate in high-demand areas, entry-level and investment properties can see price reductions as overall demand cools. Sellers become more motivated, which can lead to price cuts or increased concessions like covering closing costs. This is not at all dissimilar to what we are experiencing the past 12 months in Arizona. Luxury homes are coming off a year full of high demand and increasing prices, while lower cost cities and entry level housing are experiencing price reductions amongst higher inventory and decreased demand.

3. Reduced Inventory

During a recession, fewer homeowners list their properties—either because they’re waiting for better market conditions or simply can’t afford to sell. This limits supply, which supports stable pricing.

The Stock Market’s Ripple Effect on Real Estate

While the real estate and stock markets are very much separate, the ups and downs of the stock market can at times influence the housing sector:

1. Wealth Effect

When the stock market is booming, investors feel wealthier and more confident. This often translates into more real estate activity, especially in the luxury market. People cash out gains to buy second homes, investment properties, or upgrade their primary residence. With 25% gains on the year in 2024 for the S&P500, this is likely a big contributing factor to the luxury boost we’ve been seeing.

2. Investor Sentiment

On the other hand, a volatile stock market can make real estate look like a safer, more stable alternative. Real assets like property are less prone to daily price swings, which appeals to long-term investors looking for security. This is why real estate often sees a surge in interest during market downturns.

3. Correlation with Consumer Confidence

Stock market slumps however can hurt consumer confidence, even if a person’s individual finances haven’t changed. This psychological impact can seem real and can reduce real estate demand, as buyers hesitate to make large purchases during uncertain times. This again is more prone to affect entry level/lower cost housing.

Real estate has long been seen as one of the most stable investments, offering shelter from the volatility of other markets – and that hasn’t changed.

Market Update

Despite an overall “flat” market, average pricing on per square foot basis is still floating around record highs at $314/ft. However, this is propped up a touch by the luxury housing market (generally considered over $1M). Without luxury homes in the mix which have been performing well, homes under $1M are averaging $266/ft, down from a high of $280/ft, a modest but measurable 5% decline.

The condo market specifically is currently one of the weaker performing market segments sitting at $315/ft average last month, down from a $370/ft record high, a 15% decline in price/ft. Condo sellers must practice patience, or be aggressive – maybe a little of both. Buyers in condo communities have more options to choose from.

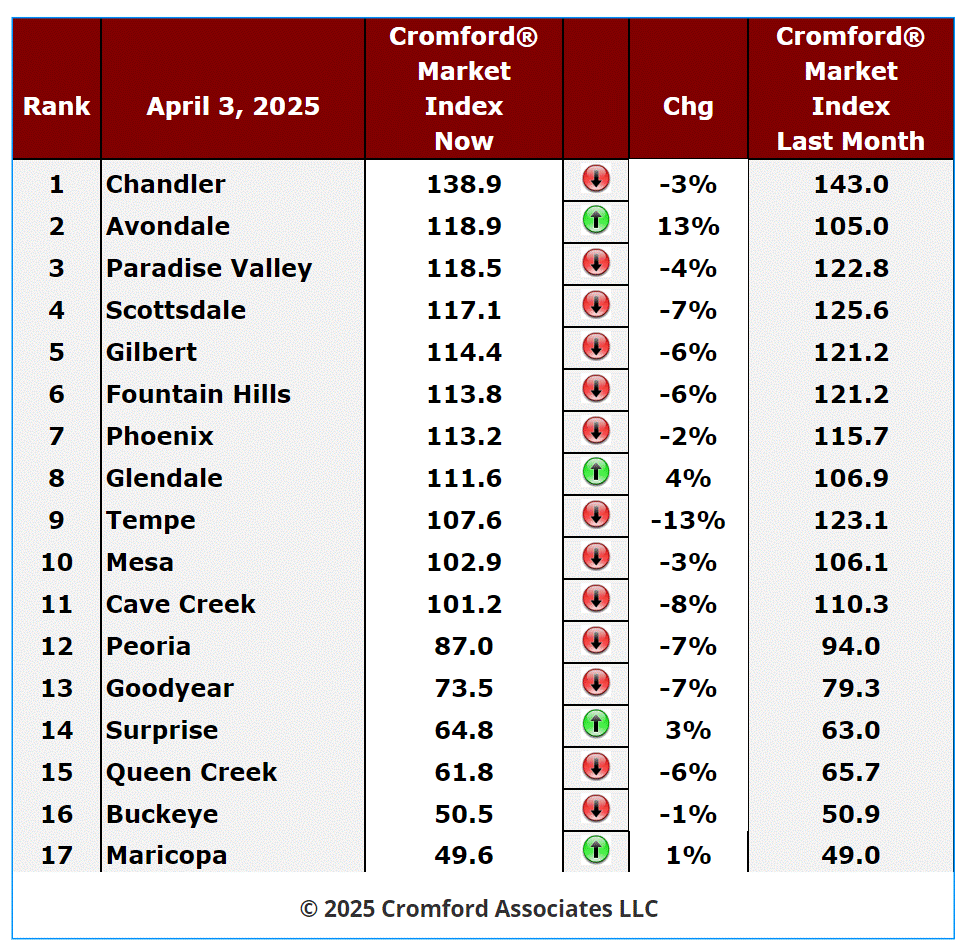

Below shows the major cities of the valley and their current index reading. Chandler remains the top spot, with a surprise jump by Avondale to the 2nd best performing area – a surprise considering it’s neighbor Goodyear is struggling towards the bottom of the pack. As a reminder a 100 reading is a perfectly balanced market where home pricing is expected to stay in line with inflation. Over 100 increases faster, and under 100 increases slower than inflation, or prices can drop.

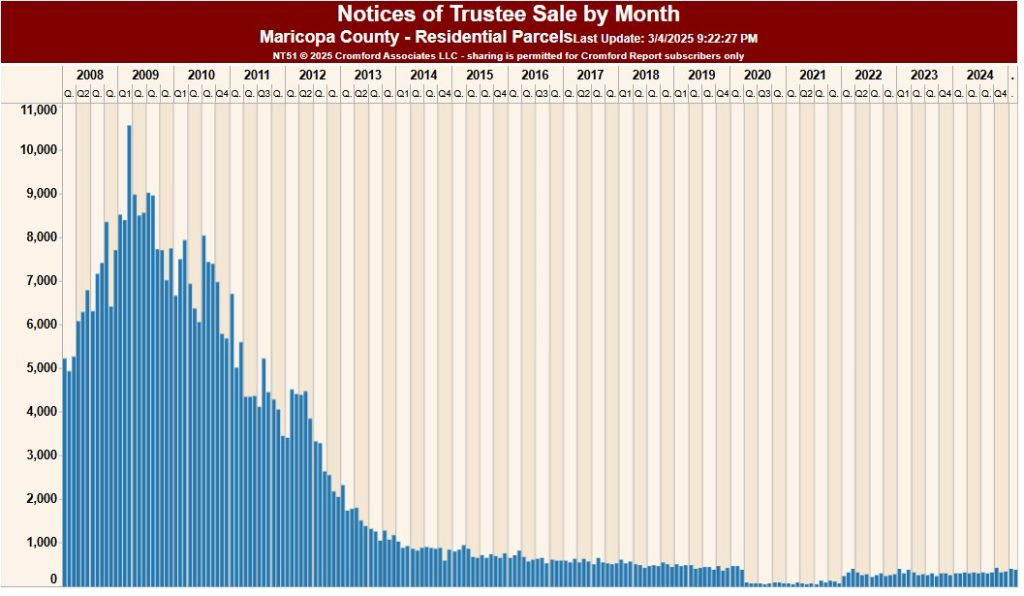

Foreclosures

Despite some completely fabricated articles/graphs that went viral on social media recently showing foreclosure rates going through the roof, there is no movement in this arena. Foreclosure/distressed properties, especially here in AZ are a non-factor in the market – with 388 notices of trustee sales last month we are very much at normal/low levels– don’t buy into the sensationalized media/social media stories

Buyers and Sellers get one piece of mutual advice today… just know your experience buying or selling a home will vary wildly depending on price point, location, financing/cash, etc. Be cautious of listening to someone else’s anecdotal experience of the market recently because your situation could be night and day difference. Please reach out to me anytime to get real information/data on your area of buying/selling and careful of what your great uncle Bob thinks!

Comments are closed.