Market Update – Fall 2024

Whether it still feels like a broiler outside or not, the fall season is technically here. While we don’t see a lot of leaves changing color in Phoenix, the colors of the license plates certainly do. With the seasonal influx of ‘snowbirds’, and the cooler weather lifting the locals’ spirits, it’s not uncommon to see a small boost in homebuying activity in the fall in Arizona. But will home buyers will stay seated, or jump back in the market this fall? Will the election have any impact on the housing market?

Interest Rates

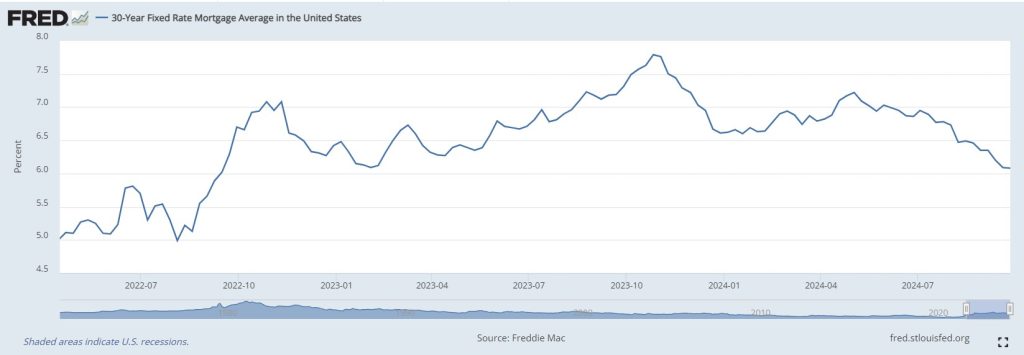

I’m hoping I won’t need to write about high interest rates for too much longer – talk about a broken record! However, as you likely know we have finally crested the peak of interest rates, and are back on our way down to a lower interest rate environment, and a good reason for home buyers to celebrate.

30 year mortgage rates are down to right around 6% on a national average, down from a peak of nearly 8% last fall. This rate marks the lowest interest rate for the past 2 years. That means nearly everyone who bought a home in the past 24 months may have an opportunity to refinance at a lower rate.

If you’ve taken advantage of some of the new home builders temporary buy downs to lock in LOW interest rates as I’ve encouraged, you are likely still at a lower rate than 6% but you may want to keep an eye on rates over the next 6-12 months and be ready to refinance – depending on the exact loan program you have.

As expected, mortgage application rates have jumped 25% over the past couple weeks as rates have come down. This surge is being led more by refinances versus new purchases, although both categories are up.

You may expect this would give a big boost to the market, but this far we haven’t seen a massive charge of new buyers coming in the market. Demand levels are still below normal. In fact, over the last 30 days, we’ve seen inventory continue to climb in Arizona, which means the market has technically gotten ever so slightly softer for seller’s overs the past 30 days, and still labeled valley wide as a neutral market where supply and demand are nearly equal.

Looking Forward

Another variable is the pending election, where some would-be home buyers will continue to sit on the sidelines, in fear of something changing (or the world ending) with either candidate being elected, based off your personal views of course.

Should the Harris ticket win the election, they have vowed to “fix expensive housing”. The proposed plan is to essentially incentivize homebuilders to build more entry level housing and over build (forcing up supply to lower demand) in order to bring the cost of entry level housing down. They have also proposed a $25,000 down payment assistance for first time homebuyers. Exactly how that would work and how it’s funded isn’t clear. It would be an interesting plan to see how that would work, but just remember that’s IF Harris win, and IF the campaign plan is actually followed through, and WHEN that would even go into place is a whole other story. In other words, don’t count on anything major changing anytime soon.

I maintain the prediction that the Phoenix area will see a large boost in buying activity and subsequent price increases in the spring of 2025. Once the election and the holidays are in the rear view mirror, combined with interest rates that should continue to decrease, the pent up buyers who were to hesitant to pull the trigger over the last 24 months, paired with the typical seasonal pattern of activity in Arizona, could all result in a substantial boost to the market.

If you are a home buyer, don’t be afraid to jump in the market earlier than the spring market with the intent of still refinancing in the next 12 months. I can see it getting very competitive for buyers once again early next year. For now, it’s an incredible time to not only have some options in homes, but a little negotiating power in select areas. While interest rates are not in the “amazingly low” category, you have the opportunity to at least secure the right house without major competition, and refinance in 2025. In other words – Marry the house, and date the rate.

Loan Limits for 2025

The conforming loan limit for 2025 is being increased to $802,650. This means any LOAN amount (purchase price can exceed this number) is considered a standard loan, and can be backed by the government, completed with standard down payments, credit scores, etc. Once you go over this limit, you are required to obtain a “jumbo” loan, which are backed by independent lenders, will have stricter qualification requirements, and generally come with higher interest rates. This additional flexibility makes it easier for homebuyers to qualify for more home to keep up with market pricing.

As always, please let me know how I can help you with your Phoenix area real estate goals.

REALTOR®

Comments are closed.