Challenges of Buying the Perfect Home – And How to Overcome Them

Buying a home in today’s market can present its fair share of challenges and obstacles – especially for first timers. Fortunately, you are not the first person to run into these home buying roadblocks and you certainly won’t be the last. So before you set out on your home buying venture, get a grasp on the potential roadblocks you could be facing, and arm yourself with the knowledge and ability to easily overcome them.

There’s no denying it, buying (or selling) a home is a process. It can be stressful, time intensive, and downright exhausting. Having a good understanding of what challenges you will be up against and understanding how to overcome them will not only make your life easier, it will get you to your goal a lot faster and you’ll be in your new home in no time.

A good Realtor will make your home buying experience as streamlined as possible with advice, resources and options. But at the end of the day, remember that YOU are the one buying a home and YOU have the final decision.

This information is generally aimed at “previously loved” homes and not new construction. New homes from builders come with a unique set challenges. Please contact me for helpful tips on new construction.

Obstacle 1 – Finding It!

Finding the perfect home is broken down into 2 distinct parts.

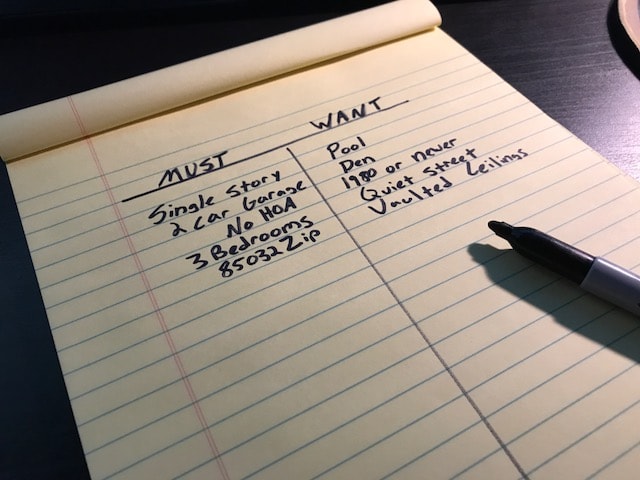

The first part, aka ground zero, is determining what it is you want. I’ve found taking the time to stop, ask yourself a few questions, and writing it down is the best way to find out what’s really important to you in a home.

Start by getting a blank piece of paper, then draw a line down the middle to make two separate columns. Title one column, “Must Have” and the second column “Would Like to Have”.

Just as the titles indicate, under the Must Have’s section, put down items in your home search that are absolutely 100% Non-negotiable. These are deal breakers and things you cannot live without or look past.

In the Would Like to Have column, put all the features and descriptions of a home that would be great to have, but if the house was perfect otherwise, you would be fine without.

Make a list of your Must Have home features and your Wants in order to help determine whats really important when buying a home.

Having this defined is important not only for you, but for your Realtor. When you give your agent a list of 15 criteria without any reference to their importance, it’s a recipe for slowing down the process. By knowing what items are non-negotiable, your agent won’t spend time looking into and showing these properties to you and will have a better idea of what is really important to you. Knowing exactly what you want will also help you tremendously with other obstacles down the line.

This is ever so critical in today market, with near record low amount of homes on the market. With so few options, you need a clear understanding of what home criteria you will absolutely not budge on.

The second part in finding the perfect home is the actual search. Now that you are armed with your non negotiable criteria, it’s time to find it. Searching on public access websites (Zillow, Trulia, etc) are simple, but can lack the tools needed to really hone in to the right properties. A realtors MLS database access is going to prove to be a much more powerful, accurate system for locating properties. These public sites are also notorious for showing properties that may have contracts already on them, but are not reflected that way and shown as available to you – a bitter disappointment. Ask your realtor to set you up on the MLS database, it’s fast, easy and effective.

Obstacle 2 – Buying It!

In today’s post quarantine home buying resurgence, just because you found the perfect home doesn’t mean you can buy it. It’s a simple fact of real estate that in today’s environment buyers greatly outweigh sellers. That means you will likely have a lot of competition to buy that perfect home. (Speaking broadly of course, it always depends on exact area, price point, etc)

In today’s post quarantine home buying resurgence, just because you found the perfect home doesn’t mean you can buy it. It’s a simple fact of real estate that in today’s environment buyers greatly outweigh sellers. That means you will likely have a lot of competition to buy that perfect home. (Speaking broadly of course, it always depends on exact area, price point, etc)

If a home is priced right, has all the features you want, and in the neighborhood you want, there is a high probability other buyers see the same value as you and will be submitting offers.

Many homes are selling at record pace as housing inventory is so low. The few new homes that do come on the market will be seen by many.

There’s no denying it, it can be downright heartbreaking to miss out on a home you had already “moved into” in your head. There are lots of tips and tricks an experienced agent can provide to help get your offer to the top of the list in a multi-offer situation. You’ll want to be prepared and committed before stepping into today’s real estate market.

Obstacle 3- Fund it!

When shopping for homes, it’s pretty easy to be pulled into a “home search bender”. You spend countless hours online, browsing, searching and discovering homes that you’d love to live in. The price starts moving up, seeing how just a little extra money gets you something even better than you imagined. And then, maybe just a little more money….and a little more…

This is fun to do, no doubt, but now I have to be the responsible one and remind you that while sometimes we drift upwards into fantasy-land, you will be paying a mortgage with very real money. Before you even start home shopping as mentioned above, you really need to take care of the groundwork and get your finances in order. I know, BORING! But really important…

Getting your financing in order means knowing:

-How much you can afford

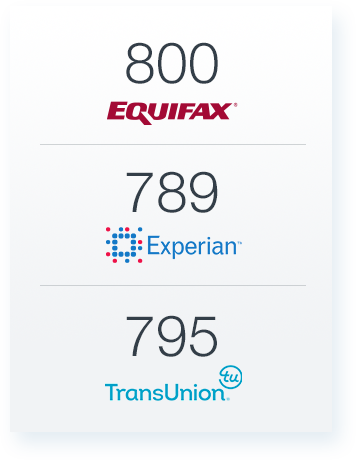

-What credit score do you have/need

-How much your payments will be

-What loan programs are available to you

-What other costs are associated with buying a home

The most disappointing thing for any home buyer is to find a home you love, only to find out you can’t afford it, OR you can’t make an offer in a timely manor because you don’t have financing yet and someone else beats you to it. By taking care of this up front you will be set up for success when the perfect house becomes available.

Also remember, the amount you can qualify for doesn’t mean that is what you should spend. Spend what is comfortable to you and fits within your budget and goals.

A note about credit – it’s a common response for home buyers who say they have not spoken with a lender yet because “they don’t want to ding their credit”. We’ve been conditioned to think this way. However, most people who are cautious to keep their credit score intact do so in order to make large purchase, such as a home. This is the reason you have such good credit, and there is usually little harm in having it checked by a lender at this point. In fact, credit bureaus allow a grace period for checks when shopping for a home loan (Around 30 days), so whether you have your credit ran by 3 different lenders or just 1 in your grace period, the impact is minimal, usually around 5 points, and will be temporary.

A note about credit – it’s a common response for home buyers who say they have not spoken with a lender yet because “they don’t want to ding their credit”. We’ve been conditioned to think this way. However, most people who are cautious to keep their credit score intact do so in order to make large purchase, such as a home. This is the reason you have such good credit, and there is usually little harm in having it checked by a lender at this point. In fact, credit bureaus allow a grace period for checks when shopping for a home loan (Around 30 days), so whether you have your credit ran by 3 different lenders or just 1 in your grace period, the impact is minimal, usually around 5 points, and will be temporary.

Your home buying success takeaways:

- Identify your must have criteria

- Set a budget that you are comfortable with and qualified for

- Use the tools and knowledge of a Realtor to find properties

- Buy the home since you are now fully prepared and qualified!

Comments are closed.