House Hunting Challenges

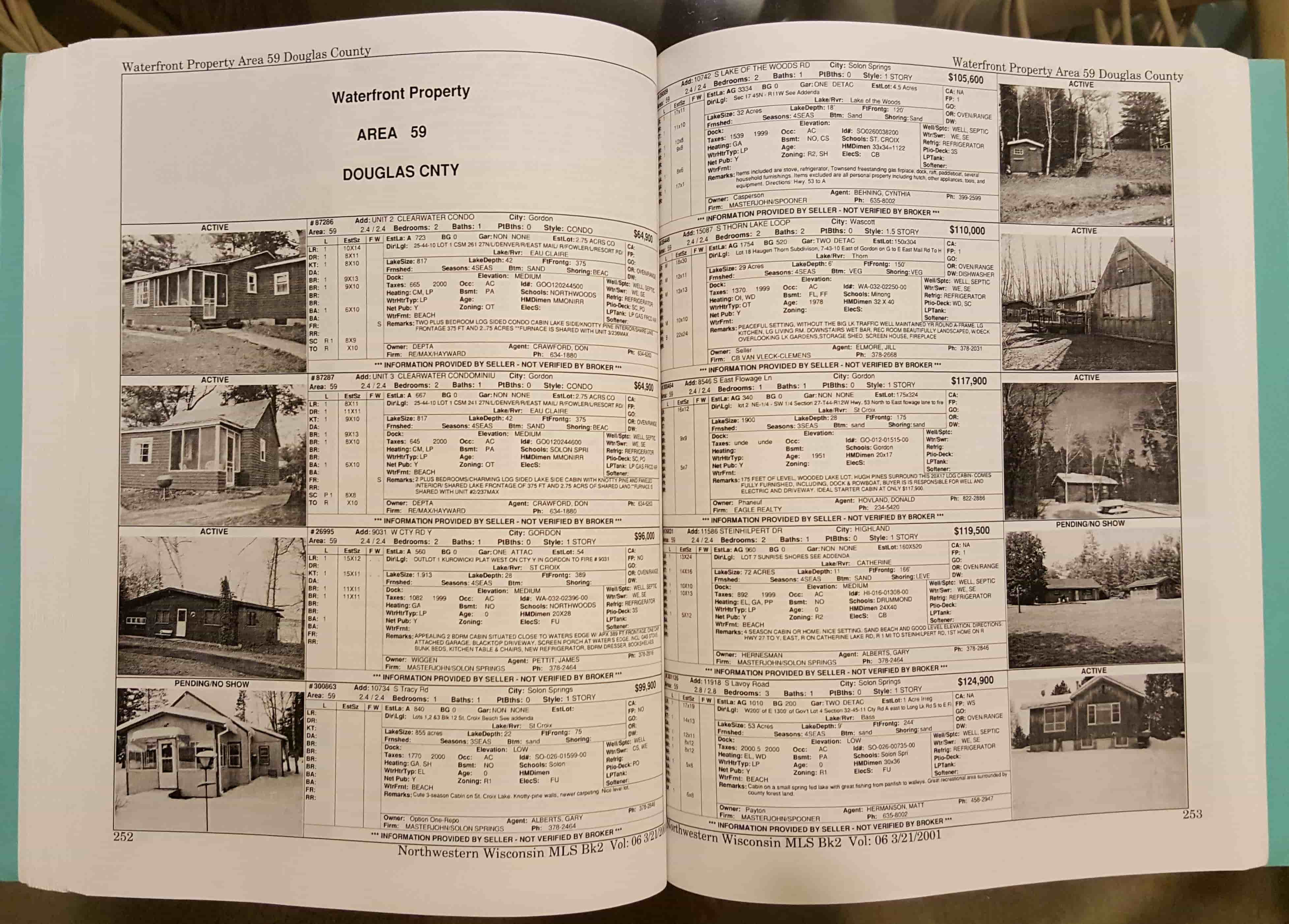

The year is 1989. You’re ready to buy a home. You jump in your Chevy Caprice station wagon and hit the streets, looking for “For Sale” signs. Without much luck, you pull out the yellow pages at home, pick up your landline and dial up the neighborhood real estate office. It’s here, where there’s a Realtor that holds the holy grail of real estate listings. The MLS listing book. It’s published every Thursday with all the new homes for sale in the area. Details are limited, and the sole thumbnail photo of the homes exterior is black and white.

It’s almost cringe worthy to think that’s the way you had to find a home. Thankfully, 30 years later it’s a whole lot easier, but there are new challenges that come with finding the perfect home in the digital world. Let’s explore.

Finding the perfect home is really broken down into 2 distinct parts.

Part 1

The first part, aka ground zero, is determining WHAT it is you want. I’ve found taking the time to stop, ask yourself a few questions, and writing it down is the best way to find out what’s really important to you in a home.

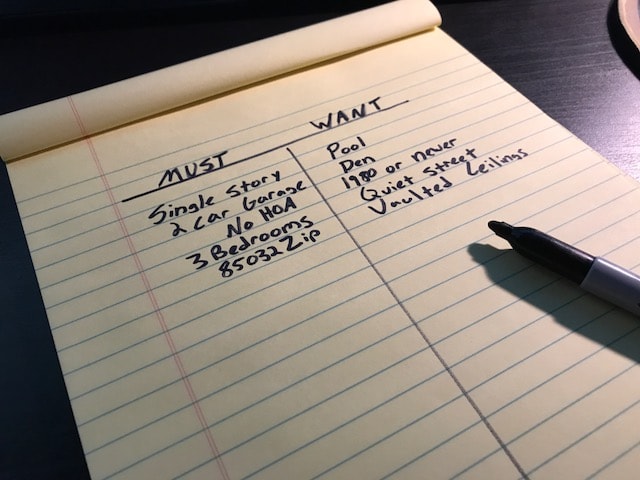

Start by getting a blank piece of paper, then draw a line down the middle to make two separate columns. Title one column, “Must Haves” and the second column “Wants”.

Just as the titles indicate, under the ‘Must Have’s’ section, put down items in your home search that are absolutely 100% Non-negotiable. These are all deal breakers and things you cannot live without or look past.

In the ‘Wants’ column, put all the features and descriptions of a home that would be great to have, but if the house was perfect otherwise, you would be fine without.

If you are buying a home with someone else, make sure you agree on these things. Trust me it’s better to figure out both of your Must Haves up front than to have a stalemate when a good house is on the line.

Make a list of your Must have home features and your wants in order to help determine whats important when buying a home.

Having this criteria defined is important not only for you, but for your Realtor. When you give your agent a list of 15 criteria without any reference to their importance, it’s a recipe for slowing down the process, and not looking at the right things. By knowing what items are non-negotiable, your agent won’t spend time looking into and showing these properties to you and will have a better idea of what is really important to you.

Part 2

The second part of finding the perfect home is the actual search itself. Now that you are armed with your list of criteria, it’s time to find the right matches. The first real issue to address comes with searching on public access websites (Zillow, Trulia, etc). While they are certainly simple, and easy to use, they really lack the tools needed to hone in to the right properties efficiently. One of the major flaws is inaccurate listing data. Remember these companies are national, and the way the data is driven to them is from hundreds of different sources, all a little unique. This means it doesn’t always translate properly.

I’ve seen listings that were sold over a year ago still listed as available. I regularly see inaccurate dates, prices, and specs on homes. The most common issue is these sites don’t have a good way or reporting what’s actually available, vs what is pending. They have been working to improve these features, but because its different in most MLS across the country there is still lots of disconnect in the data, especially here in Arizona.

The Realtor MLS database is still the holy grail of accurate up to date listings. This is the most powerful and accurate system for locating properties. MLS contains more properties than what you see on public facing sights. Agents have access to ‘coming soon’ listings, as well as listings that are not syndicated out to the big box sites like Zillow, which sellers sometimes do not want.

So the moral of the story is, while the big box sites are just fine for starting to look and to get ideas, when you are actually in the “ready to buy” mode, you are shooting yourself in the foot by not working with an agent with access to MLS properties.

Now you would think that house-hunting would be easier today than ever. After all with the internet buyers can find properties, view high res pictures and loads of details with a few clicks. 3 hours and 187 properties later you feel like you’ve seen it all. However with this ease of access, there’s an issue I’ve noticed and it goes something like this:

You look at aaall the properties in your price range and area. Some of them have pretty new granite that you really love others have a nice pool that you would love. A few are nice cul-de-sac lots with extra-large yards, and there was a few with completely renovated spa like bathrooms that would be great to have. So, all these items are on you want list and they all seem to be available in your search and price range so why shouldn’t you settle for anything less than having all these features??

Well, you CAN have all those features, but if you put ALL those features onto the same house, the price range just went up by $75,000, and that house that you have put together in your mind may not exist (in your budget anyways). Careful not to fall into this trap or you might be stuck looking for the perfect house that was never built. Once you are armed with your list and know what’s available (and realistic) in your budget, you can move forward with the confidence of locating a home with everything you need and more.

And we can’t talk about challenges of buyers today without touching on the competitiveness of entry level housing. The lower the price range, the more competitive the home buying process is. Buying in the sub $250k range you will most likely be up against several other buyers as well. The solution to surviving a bidding war is not a one size fits all. A good Realtor will have a few options based upon your situation to make your offer as enticing as possible to a seller.

Lastly, while today’s topic isn’t on financing, it’s an incredibly important part of the home search process not to be overlooked. Getting pre-qualified should be done WELL in advance of deciding on price range. There is no worse feeling than looking at $600,000 homes, falling in love, and realizing you can only afford monthly payments on a $400,000 property.

It’s never too early to talk to a lender. In fact, most lenders are happy to provide advice at any time on how to prepare your finances and talk scenarios for a future home purchase.

Happy house hunting!

Contact Me

Comments are closed.