A Simple Real Estate Money Making Recipe

Making a smart investment has nothing to do with a price of the house. OK, maybe a little bit, but the fact of the matter is many people (I’m talking about you Millenials and renters out there) fail to realize the golden opportunity that is upon us ALL right now. With interest rates remaining at record low rates, the cost to purchase a home is exponentially cheaper than it has ever been in the past.

Yes, housing prices have gone up in the last few years. So if you are looking to buy and sell in 6 months for a profit, you probably missed that window (for now). But if you need a place to live or you feel like participating in the greatest and highest yielding investment going back centuries, real estate is so ripe for the picking it’s not funny!

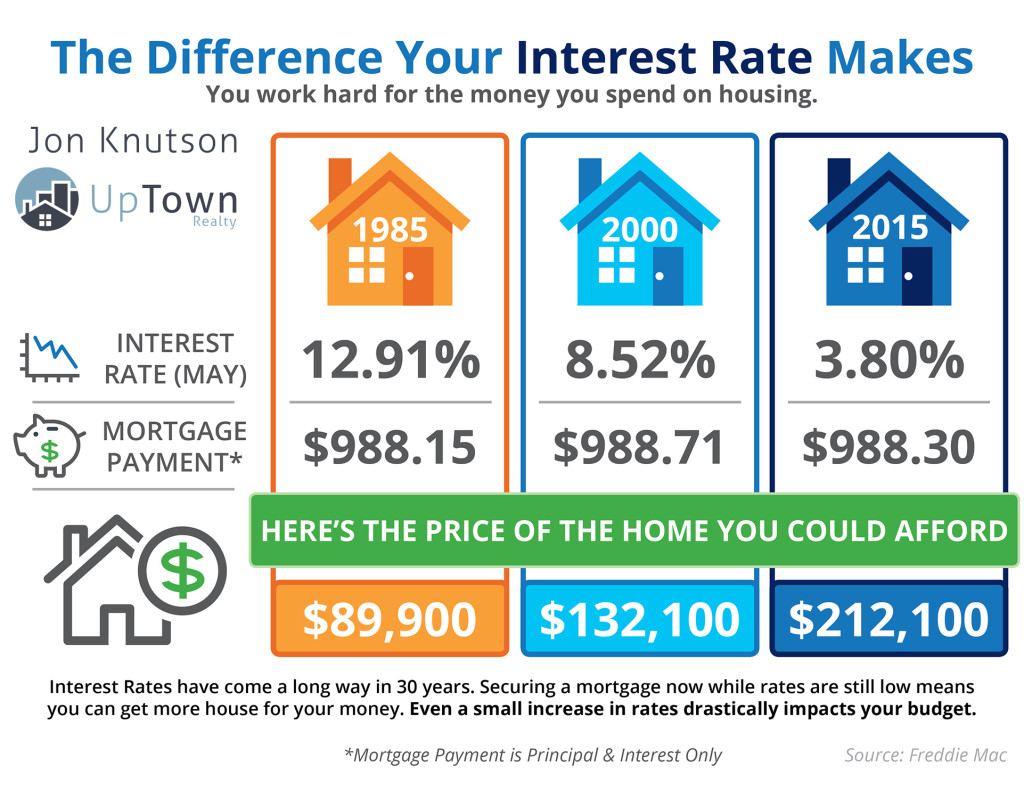

Take a look at this graphic to illustrate what you can buy today vs previous years.

At some point, you or your parents most likely borrowed from the bank at rates in excess of 10% to buy property, and that was simply the norm. Today, the norm is SO much lower that we take it for granted. Take a quick look back at history and realize this incredible advantage you have over previous generations and time periods.

At some point, you or your parents most likely borrowed from the bank at rates in excess of 10% to buy property, and that was simply the norm. Today, the norm is SO much lower that we take it for granted. Take a quick look back at history and realize this incredible advantage you have over previous generations and time periods.

My belief that is holding back ready and capable buyers right now, is they think they “missed the bottom” or are “jumping in too late”. It’s an understandable and an easy conclusions to make. The reality is, no one knows when that bottom occurs, or what the next move in the market is. Do some people get lucky and buy at the exact perfect time to make huge gains on their property in little to no time? Sure, they are LUCKY and I assure you are not the large majority.

Fortunately for the rest of, we have time to thank for a recipe that will 100% guarantee to put us in a financially better position than those who decide to continue to rent their homes. Consider this hypothetical scenario:

Omar rents an apartment for $1,000/mo. His rent increases at market rate, typically about 3% per year. He lives here for 10 years. During this time, on rent alone, Omar has spent exactly $137,566.66.

Jesse on the other hand decides to purchase a home with a 30 year mortgage equivalent of $1,000 a month. Let’s say he uses a down payment assistance program, and comes out of pocket for absolutely NOTHING to buy his home. (yes, they are even giving away money for down payment help these days!) In 10 years, he has spent exactly $120,000.

So Jesse spent about $17,000 less for housing than Omar. He also has a tax advantage over Omar every single year. But that’s nothing compared to the real fun of the formula. Since Jesse is actually paying towards equity, he now owes about $113,000 on the home he bought for $155,000, giving him $42,000 in equity. If he decides to sell at the same price, less fees, costs, etc, Jesse winds up with $32,000 in his pocket, and $17,000 that he never had to spend in inflated rent price.

Omar in ten years: Spent $137,566 on rent and received nothing in return.

Jessie in ten years: Invested the same amount into a mortgage, walks away with $49,000 plus appreciation.

On top of that, this formula doesn’t take into consideration the increase of housing prices. Over a 10 year period he will more than likely see a very nice increase in value which adds dollar for dollar into his pocket.

Now, when we plug these same numbers into 1985’s interest rate of 12.91% in ten years, Jesse would be able to sell and BARELY break even due to the high interest rates. Today’s incredibly low interest rates allow us to capitalize on this opportunity.

So, before you decide that housing prices are just too expensive, or that you’ve missed the last “run”, decide if your long terms goals align with a real estate investment, you’ll thank your future self.

Search the MLS Here

Leave a comment