What’s Actually Happening With Home Prices?

One headline says home prices are up 26%, and another says they are down 6%. So, what’s REALLY going on here? Well actually, both are right to some extent. It’s not a surprise that the media has a way of spinning the facts. Sometimes it’s by accident with outdated data, and sometimes it’s reporting on headlines that are sure to get clicks and views. Let’s dive in to what is REALLY happening in the Phoenix area real estate market – by the numbers and facts!

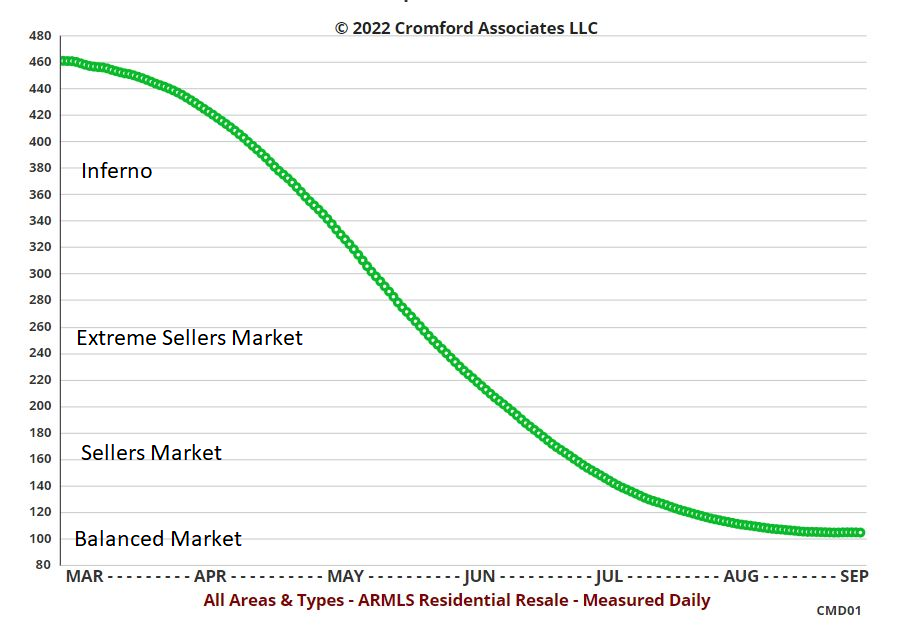

We all know that the market was HOT coming into this year. Just how hot it was is probably still not grasped by many. We have been so undersupplied of homes for so long, it was without a doubt the “hottest” market we’ve ever experienced.

The cooling point was the interest rising up off their record setting lows. These increased the total cost to buy, which undoubtedly priced some home buyers out of the market, and many put their plans on the back burner.

This allowed inventory to build up over the last several months. Inventory rose dramatically between April and June. Since July however, homes have been coming to the market substantially slower, and nearly everything is being absorbed at the same rate as they are coming on. This is what happens in a balanced market.

Balanced Market

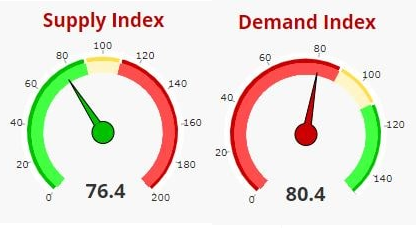

Despite inventory rising hundreds of percent since the start of the year, we STILL have 10-15% less homes for sale than what is considered a balanced market. However, demand is also about 5-10% below normal levels, so the combination of the supply/demand together gives us a market that is balanced – just a touch better than balanced, technically speaking.

In a balanced market, home prices are expected to appreciate around the levels of inflation.

This graphic represents the supply & demand levels that we’ve seen over the last 6 months.

It’s a dramatic change – but economic principles prevail once again. It was decided by the ‘powers that be’ that consumer demand needs to be weekend, and the rising interest rates did just that. 100 represents a balanced market, which is right where the increased borrowing costs pulled the market to.

This shows us statistically, the market has now found balance and is no longer in a softening trend. We find ourselves in a very “normal” balanced market. A market where it’s customary for homes sell in weeks or months, not hours and days. It’s an adjustment back to normalcy, but not a sign of a market that’s in trouble, or continuing to weaken.

Prices

So, how is it possible that the market is up 26% and down 6% at the same time? The way prices are measured can be done many ways. In this example, 26% appreciation is the amount Phoenix has appreciated year or year, from August 2021 to August 2022. The 6% decrease in prices is what happened from the highest recorded average sale price (per sq ft) in May/June to the lowest sale price recorded in August, a much shorter timeline, which can often misconstrue the big picture.

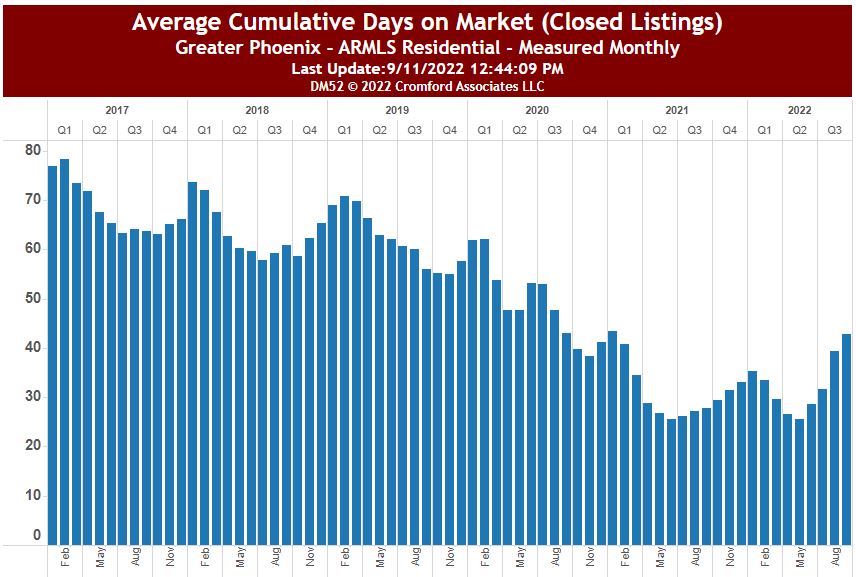

When measured in short time frames, it’s actually quite normal for prices to move down on a month to month basis. It happens nearly every year at some point, usually during the summer slowdown– Even from June to August of 2021 we saw average monthly prices drop, which still had one of the biggest years of home appreciation ever.

You also need to be careful on what is being reported, there’s a substantial difference between what’s happening in your neighborhood, vs a national level. Most reports you’ll see are statewide, or national, and may be a stark difference from what is happening in your zip code or municipality. Some parts of town are actually moving in favor of sellers once again (Paradise Valley, Scottsdale for example). Others parts of the valley are officially in buyers’ markets (Buckeye, Queen Creek, for example).

If you are planning on buying or selling, it pays to know what is really happening in your neighborhood. Making lowball offers might fly in some areas, but sellers have control in others areas.

It’s the compilation of all cities in the Phoenix metro which provide us the current balanced market reading. So, if the average has never made it into a buyers’ market (where prices come down) why have the average prices softened in the last few months? Besides that this can actually be totally normal in an appreciating market, as mentioned, I think there’s a few other theories to explain what we are seeing – The first being knee jerk reactions by sellers who feel like the sky is falling, when we just shifted to “normal” rather quickly.

Secondly, there’s another super interesting situation happening that has to do with iBuyers. iBuyers are the institutions that buy your home for cash (typically below market value), then resell it for a profit. There are really just two iBuyers left operating in Arizona (after Zillow’s massive failure at its attempt at iBuying in 2021) These two iBuyers make up about 12% of the homes that are currently on the market, which is quite a sizeable market share.

What’s happening is similar to that of 2008 when banks were sitting on excess of vacant homes. Now instead of banks, it’s iBuyers who are sitting on a few thousand vacant homes way longer than their business plans called for. They have been slashing prices to BELOW market values to get properties off the books, as their holding costs for these homes pile up. The side effect is these are now comparable home sales that bring down the values for others in the neighborhoods they are selling in, just like bank owned properties did in the foreclosure years. This affects the lower/middle income areas of town the most where iBuyers primarily operate.

Now, the banks in 2008 couldn’t stop the flood of homes that were coming back to them by the tens of thousands. iBuyers have complete control over how many homes they acquire moving forward. So it’s a fairly safe assumption they are drastically reducing the number of homes they are acquiring. The likely result is they will now only pay ridiculously under value for a home, instead of just a little under value, to ensure profits and a more timely re-sale. Once they sell some off some more properties, these comps will cease their negative effects on the everyday homeowner in those neighborhoods. There are many recent stories of iBuyers pulling the rug out from under homeowners on homes they had agreed to buy. Sellers considering selling to an iBuyer – please reconsider.

Buyers – For the buyers who have been saying “I’ll wait until things aren’t as crazy”, now’s your time. You might even catch a few sellers who are still in a little bit of panic mode from sitting on the market this summer. There are a handful of sellers who listed with last years mindset of “list high and watch the offers fly in” who now have been hit with reality and might be ready to make a deal. There are options to secure below market interest rates to help with monthly payments, just ask me for more details on the loan programs available right now.

Sellers – Be patient, and be realistic. The free-for-all where buyers are giving away the naming rights to their first born for an opportunity to buy your home is over. Buyers now have many more options, so a home that needs work and is not priced well is going to sit. Updated and move in ready homes in desirable areas will typically be the first ones to sell. Around 70% of homes listed are selling successfully, versus 93% in March of this year (which was an all-time record high, by the way). It’s taking around 45 days on Average to sell a home.

Please reach out to me should you have any questions, considering buying or selling a home, or looking for detailed information on your neighborhood. I’m always here to help.

Comments are closed.