Market Update

Remarkable. It’s the only word I can come up with to describe the real estate market in Arizona. A record breaking summer is continuing with no signs of slowing down. So, how did we get here, and where are we going? Let’s dive into the latest details of the Phoenix housing market.

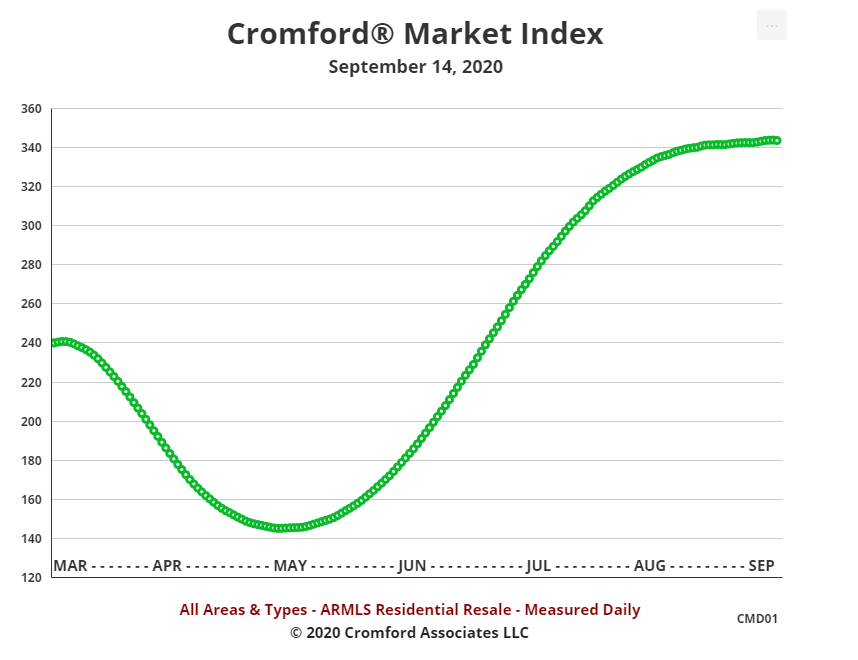

If you follow my blogs regularly, you’ll recall that just like everything else, real estate transactions essentially stopped in a knee-jerk reaction to the Covid pandemic in March (our peak buying season!). Activity and demand slumped for 30-45 days while everyone tried to figure out what in the world was happening.

No faster than it dropped, demand starting picking right back up again. The move was swift, and there was no time for any major price changes. The only real measurement that we could see this happening on was supply/demand ratios, which dictate future housing prices.

From that lowest point in Mid May, demand starting picking up, and did not let off the vertical acceleration until August. Since then, we’ve been on “cruise control” with a sustained high demand for homes, with very little homes available for those people to buy.

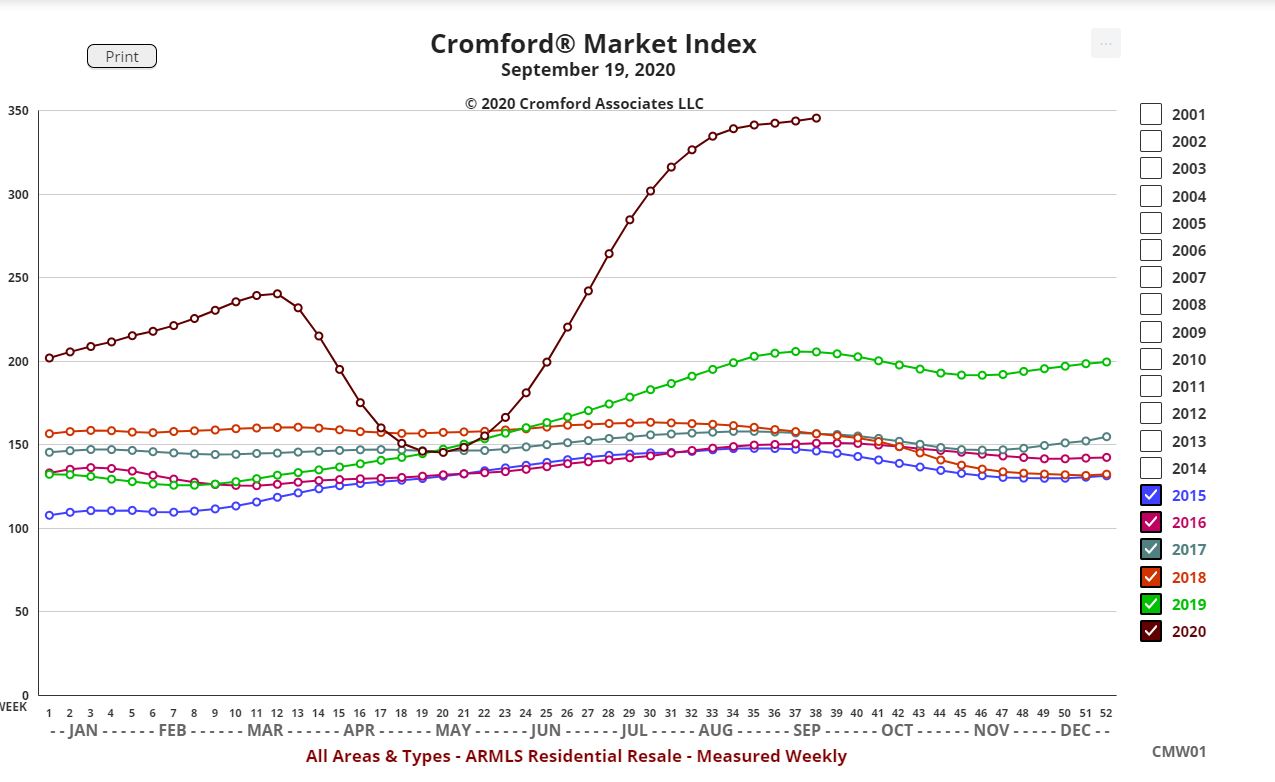

To understand where this falls compared to a “normal” Phoenix seasonal pattern:

This low supply with high demand is what drives prices upwards, so over the last two months we are seeing the effects of this catching up, and prices are moving upwards.

Since the low in May of $183/ft average sales price, we are now up roughly 8% at $198/ft. Since there is several months of lag between the current supply demand and closed home prices, this mean closed prices in the coming months will continue to post even higher.

As we hover around the all-time record of $200/ft valley wide average today, we have to wonder where we go from here. While no one has a crystal ball (and boy did 2020 make that obvious!) we typically see a real estate slowdown in the months leading up to an election, for fear that the world could end if the “wrong” candidate gets into office. Home buyers may often want to want to wait to see what happens with the election. This year, who knows if that slowdown will even occur. After all, the world already ‘ended’ earlier this year!

Here’s my take on the major driving forces in the real estate market moving forward:

The work from home shift looks like it’s here to stay. While certainly many people will make their way back into offices over the next year, a lot of companies that were forced to have employees work from home will realize maybe it’s not so bad after all. These employees need proper offices to work from at home full time. I don’t think a kitchen counter top workplace is sustainable, and these people needing more space at home are likely going to go out and find it in another home.

Additionally, permanent work from home situations now have no need to be within commuting distance to an office. Why not pack up and go live in a more affordable or better location than being tied to an area strictly for work?

I would also guess this shift of staying at home more frequently outside of work is here to stay for a while as well. With so much time spent at home, you want enough space, and a functional space for the whole family. It’s no wonder activity like pool building, yard and home renovations are through the roof. But if the space isn’t big enough for improvements, you have people potentially looking to upsize to a home they can spend plenty of time in without feeling locked in.

Lastly, the financial motive is at absolutely at play. Most current homeowners are reaping the rewards of home ownership with substantial equity in their homes. Moving these gains to a new home and they may find that they can now afford a much larger/nicer home. Pair this with the insanely low record level interest rates, and it’s easy to see the motive.

I’ve said it many times over the past several years, and I’ll say it once again: Buyers who are waiting for lower prices to come around are going to continue to be bitterly disappointed.

Contact Me

Comments are closed.