Why Arizona Home Prices Aren’t Crashing (Even Though Everyone Thinks They Should)

If you’ve been waiting on the sidelines for home prices in Arizona to crash…

You’re not alone — but you’re also still waiting.

Despite higher mortgage rates, economic uncertainty, and affordability challenges, home prices across Arizona remain surprisingly resilient in 2025.

So what gives? Why haven’t home values in Phoenix fallen off a cliff? Let’s break down the real reasons behind Arizona’s sticky prices—and why the “housing crash” headlines are missing the bigger picture.

What Logic Says Should Be Happening

Let’s start with what you’ve likely been hearing or thinking:

- Mortgage rates are hovering around 6.5–7%

- Monthly payments have nearly doubled for the same priced home since 2020

- Affordability is at record lows

- Buyer demand has cooled

All very true, so shouldn’t prices be falling dramatically? In theory—yes. But in Arizona’s case, the housing market includes some additional factors at play.

The Real Reasons Arizona Home Prices Aren’t Dropping

1. The “Golden Handcuff” Effect

Thousands of Arizona homeowners are locked into 2–4% mortgage rates they got during 2020–2022.

They don’t want to trade their $2,000 payment for a $3,500 one, for an “equal” home. even if they are sitting on big equity. The end result: Inventory stays muted because people aren’t moving.

2. Population Growth Isn’t Slowing Down

Arizona is still a net in-migration state, especially from California, Illinois, and Washington.

People are chasing sunshine, lower taxes, and lower overall cost of living—even if it’s not so “cheap” anymore. These people need places to live.

3. Investors Are Holding the Line

Large investors (and small-time landlords alike) are not selling unless they absolutely must.

Many bought homes in cash or locked in low rates, and the rental income still makes sense.

In vacation hotspots where short term rentals/airbnbs were considered saturated over the last few years, many investors are converting into long-term rentals instead of selling.

4. Sellers Would Rather Rent it out

When Arizona homeowners do need to move, many are choosing to rent out their current property instead of selling it at a perceived discount. Again, owners with the 2-4% interest rates want to retain their mortgages, and can generally turn their primary into a cash flowing rental home quite easily.

What Could Actually Make Prices Fall?

If you’re a buyer hoping for a big drop, here’s what to watch:

- Massive job losses (especially in tech or tourism sectors)

- Huge spike in inventory (unlikely unless forced selling kicks in)

- Sudden drop in demand (while demand has been subdued for the better part of 2 years and below ‘normal’ levels, it hasn’t fallen off a cliff)

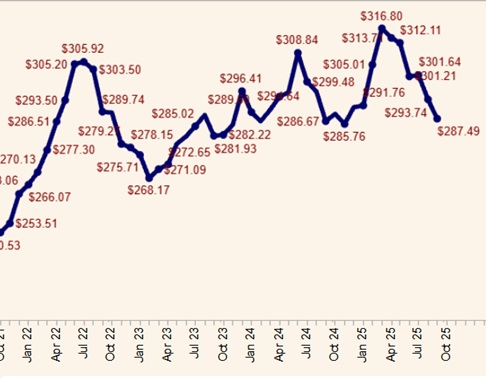

Since January of this year, YES the average sales price per foot is down by nearly 30$/ft, however we are still flat from this time last year. These are seasonal and temporary shifts which create small ups and downs in the greater picture.

So… Should You Buy Now or Keep Waiting?

Whether or not you should buy a home now comes down to your personal goals and timeline. If you’re planning to stay put for at least five to seven years, want to build equity, and can comfortably afford today’s monthly payments, buying now makes a lot of sense. While rates are higher than the pandemic lows, prices have remained relatively stable, and many buyers are negotiating better terms, closing cost credits, or rate buydowns from motivated sellers. Plus, you can always refinance later when rates drop (by the way that’s what Trump is pushing for), but you can’t go back in time and buy a house at last year’s prices.

On the other hand, if your financial picture is uncertain, you’re not sure where you want to live long-term, or your goal is to flip or exit in under two years, it might be worth holding off. Renting can provide flexibility, and it may give you time to save more, improve your credit, or wait for more favorable loan terms. Just don’t fall into the trap of endlessly waiting for the “perfect time”—especially in Arizona, where strong population growth and limited housing supply continue to drive long-term value. Ultimately, let your goals—not the headlines—guide your decision.

Comments are closed.