Market Update – No, it’s not another bubble

Home price have been rising for years on end. Buyers in bidding wars and paying over asking price just to get their hands on a piece of property. Sounds like another bubble is coming?

Not quite. It’s easy to think that given just ten years ago we were going through one of the most significant Real Estate/housing events in the United States history. But it was just that, a significant event that is not going to repeat itself anytime soon.

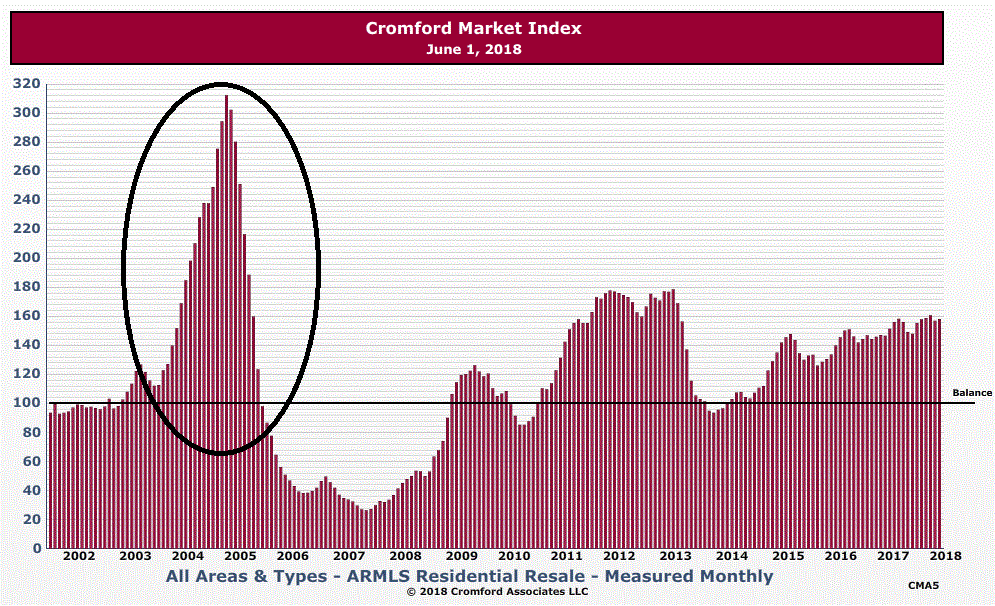

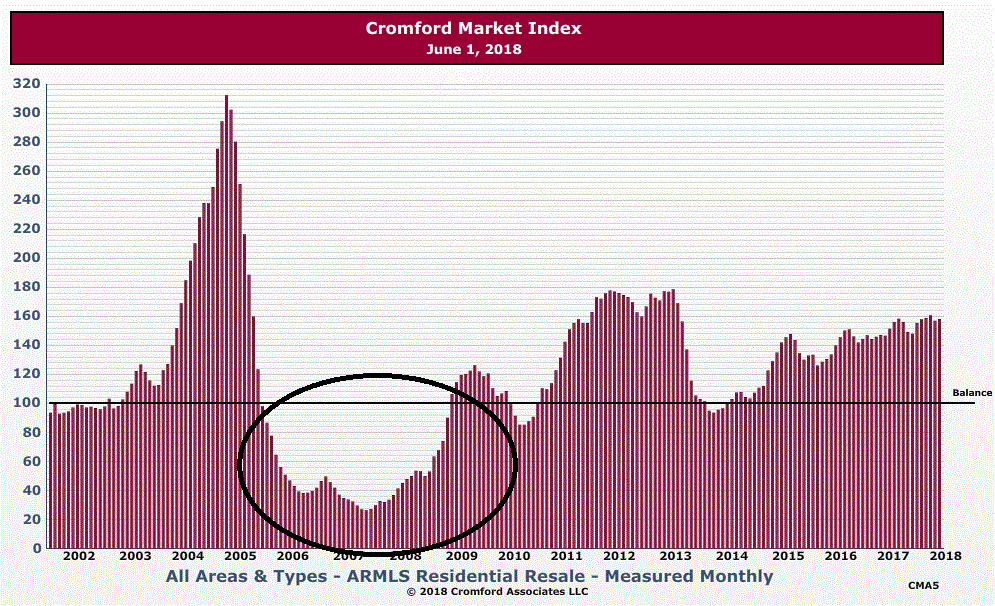

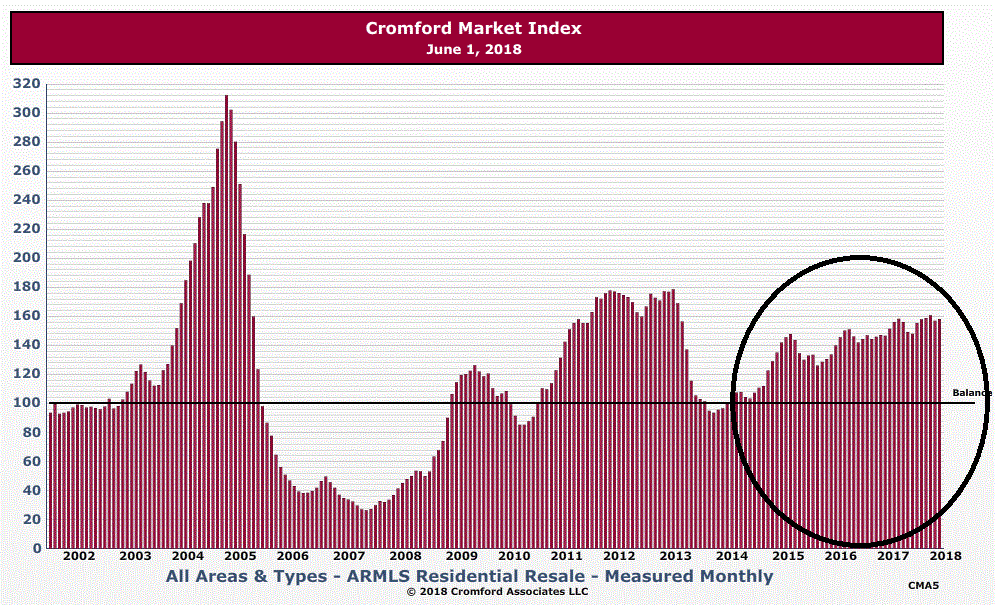

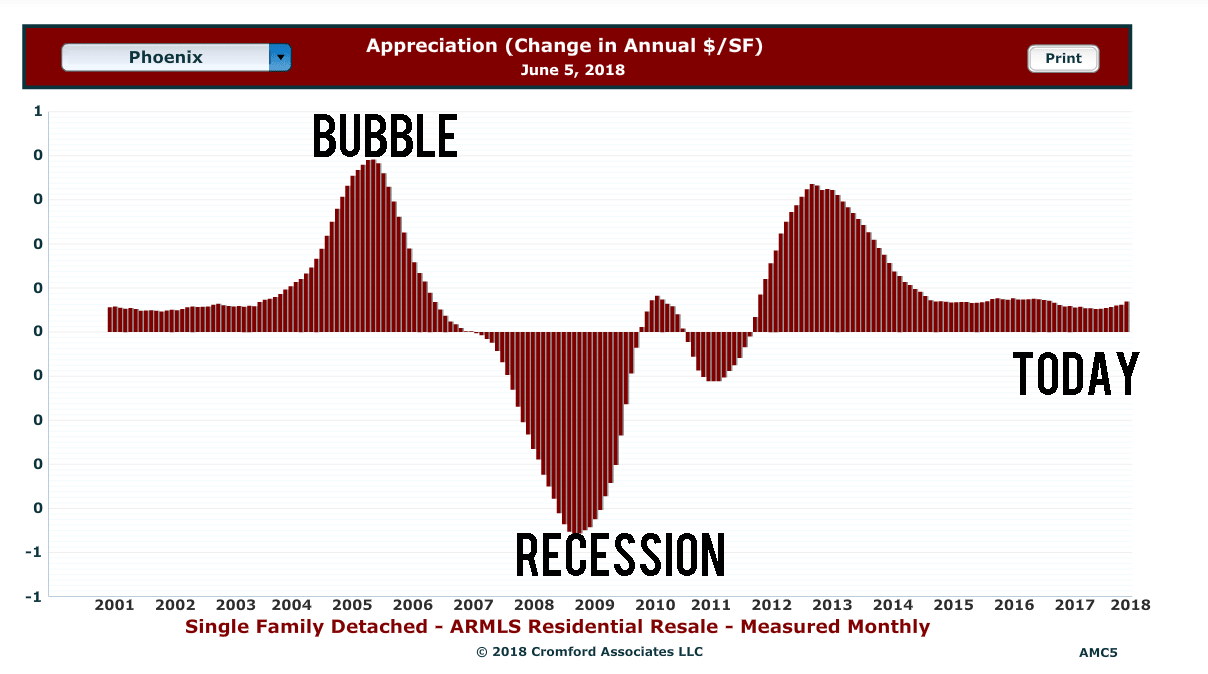

Take a look at the below graphic illustrating the Cromford Market index for the Phoenix area.

This is what a bubble looks like.

This is what a recession looks like.

This is the last 3 years through May 2018

In other words, we are just above the “balance” line indicating a slight sellers market. (below the balance line indicates a buyers market)

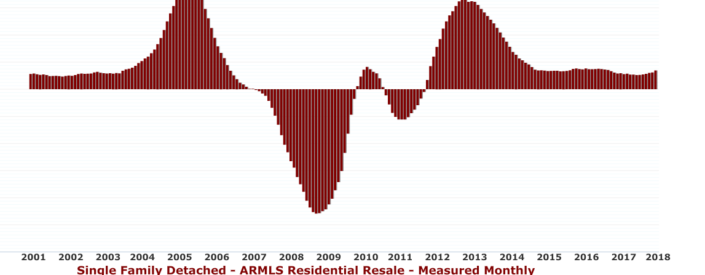

Now take a look at the appreciation rate for the city of Phoenix, you’ll notice it’s a similar pattern to the Index, but shows where the last 3 years have appreciated at almost the exact same rate. Can you say stability?

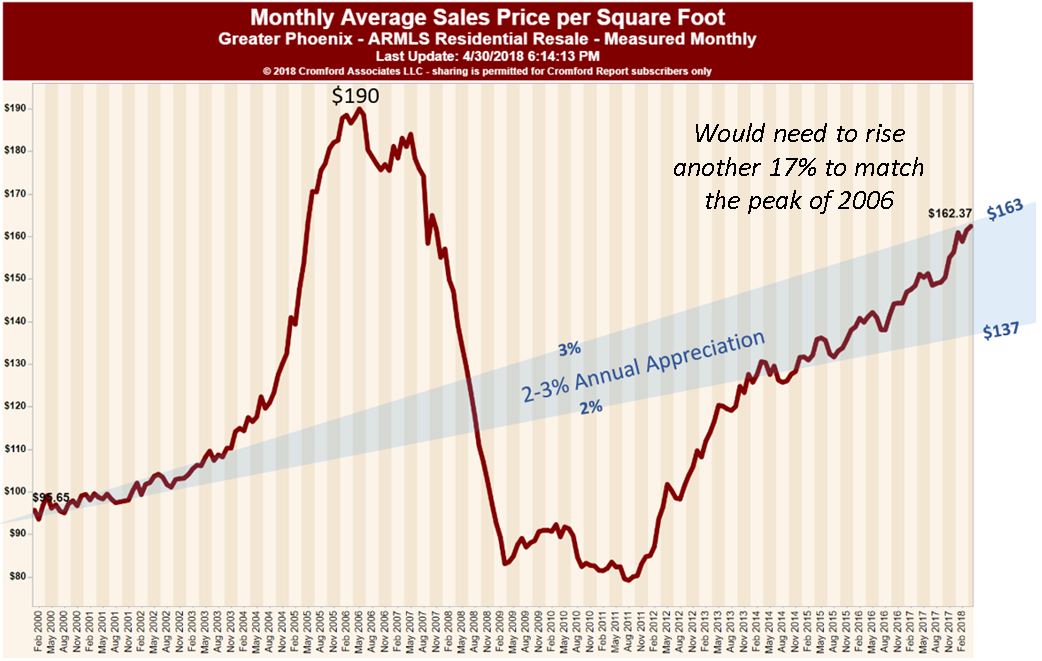

Lastly, below represents the average sales price (per sq ft). The blue 2-3% line indicates where a stable market should be appreciating at roughly 2-3 % per year.

Clearly in 2003 we broke loose and got way out of line. However, look where we are today. If you fell asleep in 2003 and woke up in 2018, we are exactly right in line with where a healthy appreciating market should be. We are not over-inflated like it may feel.

So as emotions go, it’s easy to jump to conclusions that prices are “too high”. Data-wise, note quite.

That doesn’t mean certain neighborhoods can be very different than others in terms of under/over valued and appreciation rates. We’re talking averages across the valley here.

I unfortunately don’t have a crystal ball, so I can’t predict what’s going to happen with 100% certainty from here. This doesn’t mean we won’t correct(which NOT the same as a crash!) at some point, because at some point we will. 1 year? 5 years? 10 years? I wish I knew for sure!

It remains a great time to sell and buy property in Arizona, and your experience will very greatly depending on your location and price range!

Please contact me if you would like specific data/trends on any particular zip code, city or otherwise.

Comments are closed.